Blog

Since days when shale oil and gas technologies were discovered, the U.S. energy industry has been evolving more rapidly than ever before. Many changes are amazing especially when you put them on an industry map. At Rextag not only do we keep you aware of major projects such as pipelines or LNG terminals placed in service. Even less significant news are still important to us, be it new wells drilled or processing plants put to regular maintenance.

Daily improvements often come unnoticed but you can still follow these together with us. Our main input is to “clip it” to the related map: map of crude oil refineries or that of natural gas compressor stations. Where do you get and follow your important industry news? Maybe you are subscribed to your favorite social media feeds or industry journals. Whatever your choice is, you are looking for the story. What happened? Who made it happen? WHY does this matter? (Remember, it is all about ‘What’s in It For Me’ (WIIFM) principle).

How Rextag blog helps? Here we are concerned with looking at things both CLOSELY and FROM A DISTANCE.

"Looking closely" means reflecting where exactly the object is located.

"From a distance" means helping you see a broader picture.

New power plant added in North-East? See exactly what kind of transmission lines approach it and where do they go. Are there other power plants around? GIS data do not come as a mere dot on a map. We collect so many additional data attributes: operator and owner records, physical parameters and production data. Sometimes you will be lucky to grab some specific area maps we share on our blog. Often, there is data behind it as well. Who are top midstream operators in Permian this year? What mileage falls to the share or Kinder Morgan in the San-Juan basin? Do you know? Do you want to know?

All right, then let us see WHERE things happen. Read this blog, capture the energy infrastructure mapped and stay aware with Rextag data!

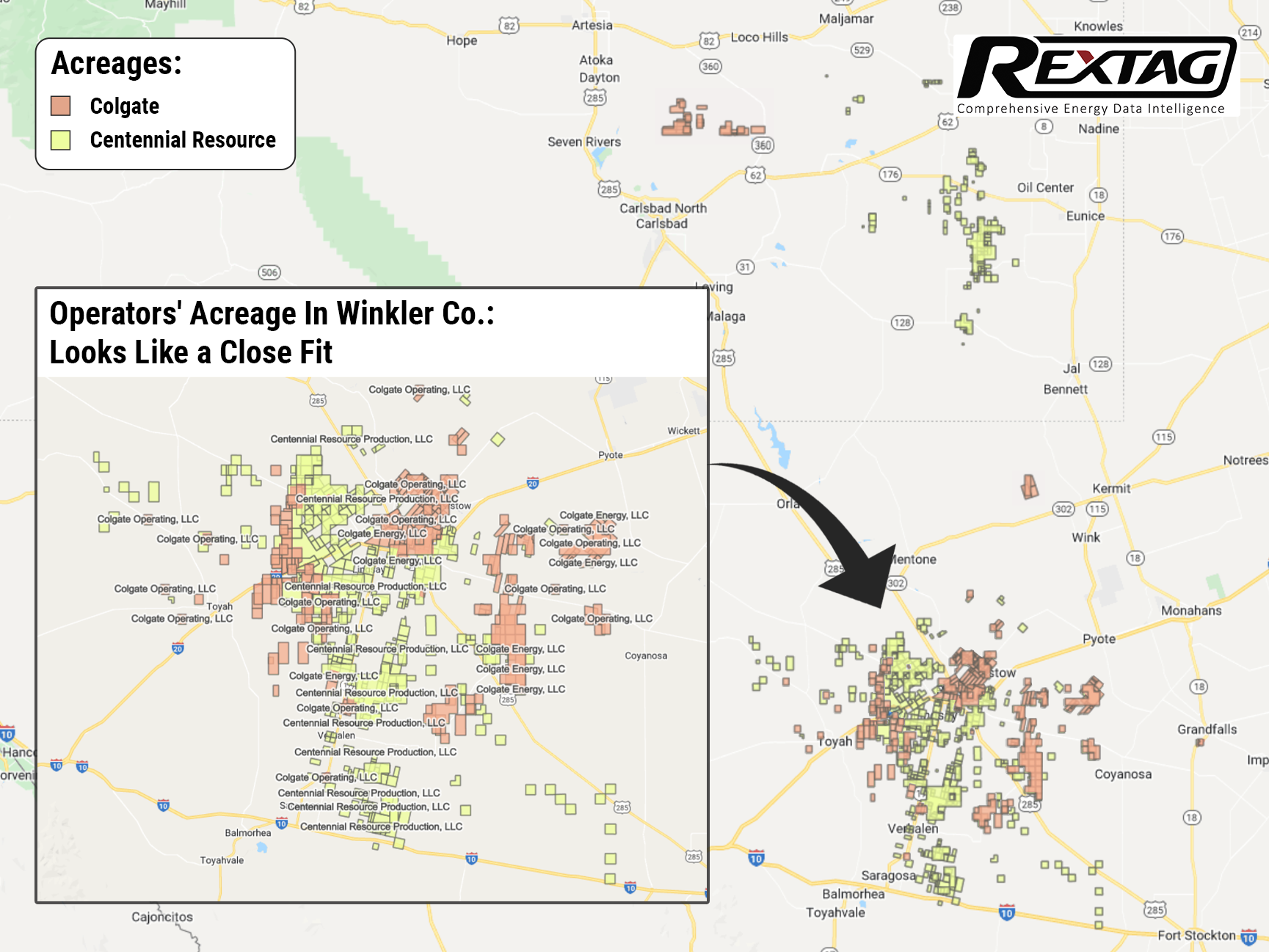

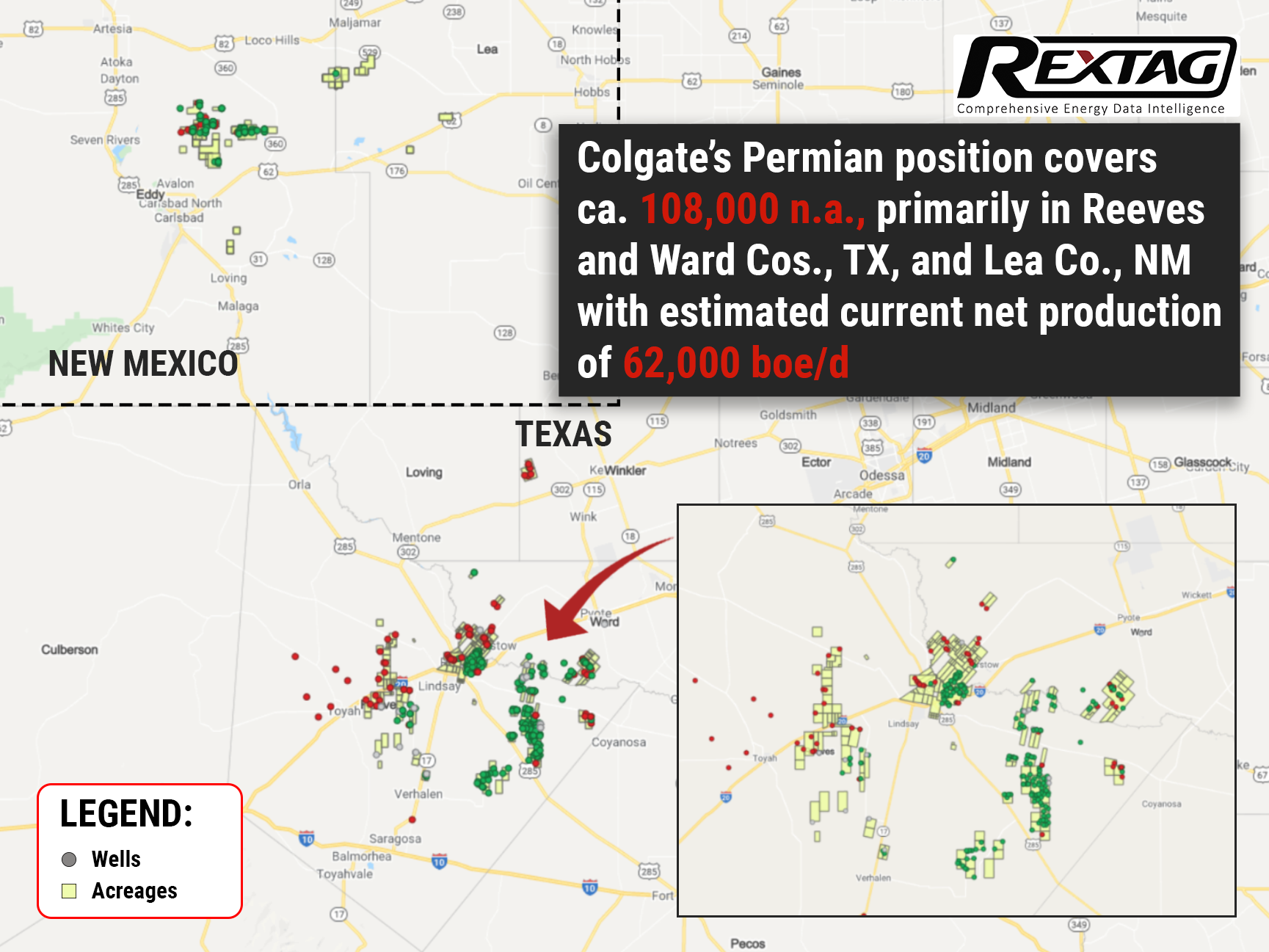

$7 Billion Merger of Colgate and Centennial, the 2 Largest Permian Operators

Despite the circulating rumors concerning Colgate’s attempt to launch an IPO, on May 19 the company decided to combine with Centennial Resource Development Inc. This merger of equals is estimated at $7 billion and will found the biggest pure-play E&P company in the Delaware Basin of the Permian. The transformative combination essentially enlarges companies’ potential and hastens the growth across all financial and operating metrics. According to Centennial CEO Sean Smith, the combined company is anticipated to furnish shareholders with quickened capital return program due to a fixed dividend coupled with a share repurchase plan. Due to a recent report, the merger would increase production 7%, to 145,000 boe/d by the fourth quarter would further ratchet up next year. By third-quarter 2023, the company predicted 160,000 boe/d based on a drilling program of 140 wells per year. Colgate Energy was reported to be getting an IPO last December that sources said would value the company at approximately $4 billion. The combined company will have over 15-years of drilling inventory, assuming its current drilling pace, the companies will produce over $1 billion of free cash flow in 2023 at current strip prices.

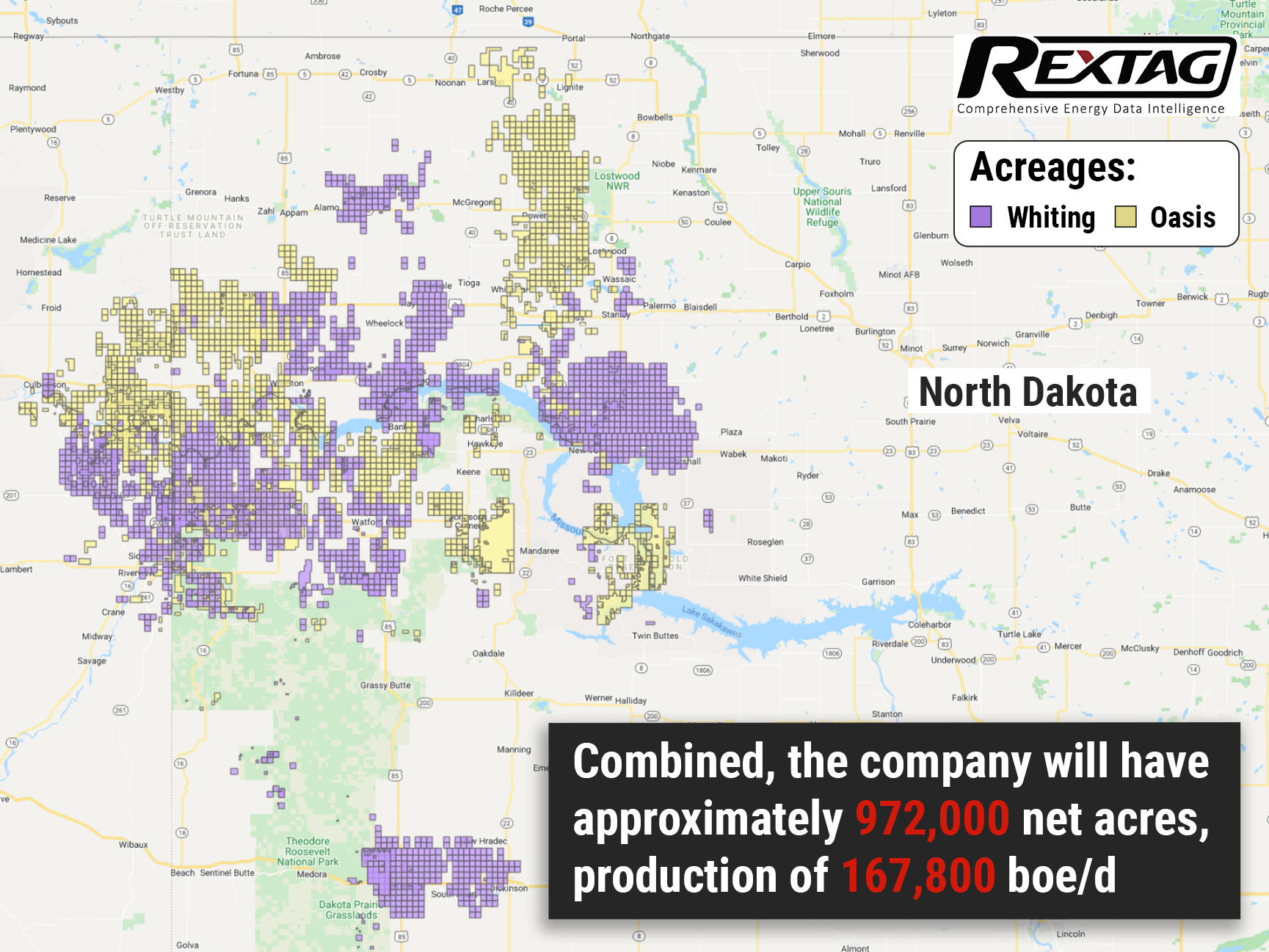

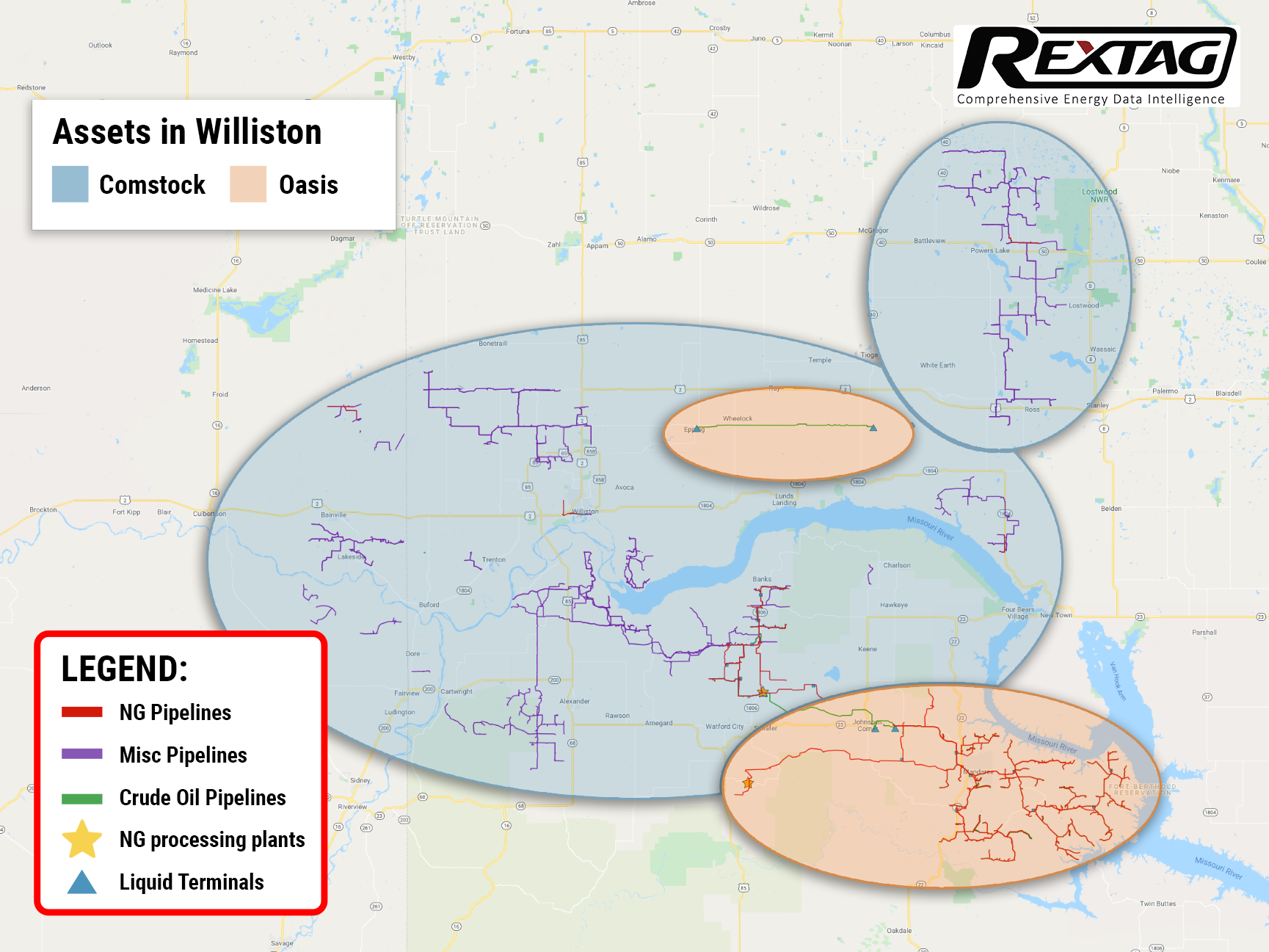

Merger of Equals: Whiting and Oasis $6B Deal

The two Bakken shale producers announced in a joint statement on March 7 that they had reached an agreement to unite in a $6 billion "merger of equals." Combining these two companies will create a leading Williston Basin position with assets covering approximately 972,000 net acres, production of 167,800 boe/d, and an enhanced free cash flow generation that will generate capital returns to shareholders. A historic collapse in oil prices prompted both Whiting and Oasis oil companies to file for Chapter 11 bankruptcy protection in 2020. Thus, the merger can be viewed as a preventive measure to avoid going out of business.

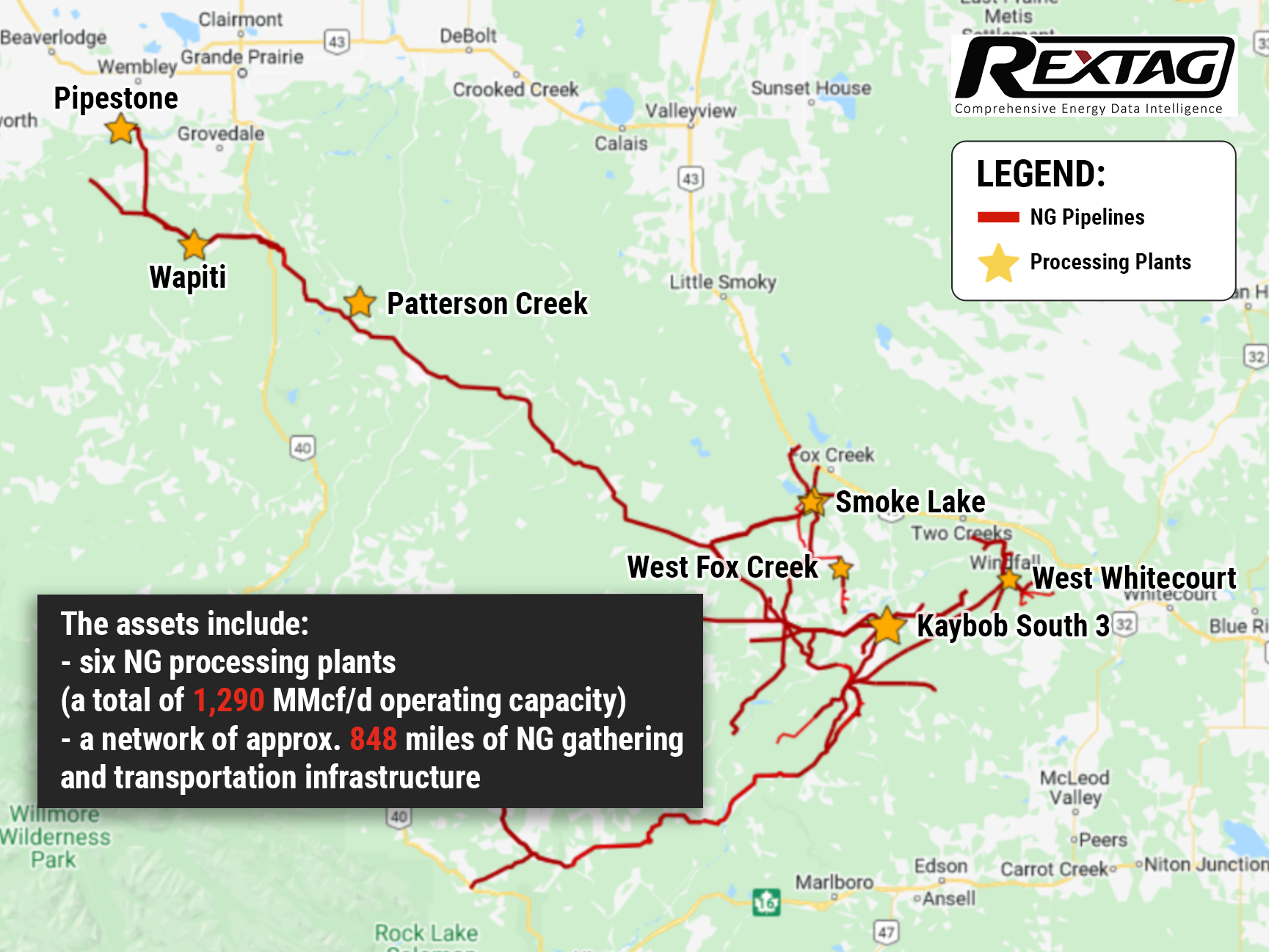

Canadian Assets on Sale: Energy Transfer Sells Gas Processing Bussines to Pembina-KKR for $1.3 Billion

Under the agreement, Energy Transfer will sell its 51% interest in Energy Transfer Canada to the Pembina-KKR joint venture, for more than CA$1.6 billion (US$1.3 billion) including debt and preferred equity. KKR's funds already own the remaining stake. TC’s assets include 6 natural gas processing plants with a combined operating capacity of 1.29 Bcf/d and an 848-mile naturalgas gathering and transportation network in the Western Canadian Sedimentary (WCS) basin. While this process is underway, Pembina and KKR will combine their Western Canadian natural gas processing assets into a single, new joint venture entity — Newco, owned 60% by Pembina and 40% by KKR. This new entity is expected to have a natural gas processing capacity of about 5 Bcf/d or about 16% of Western Canada’s total processing capacity.

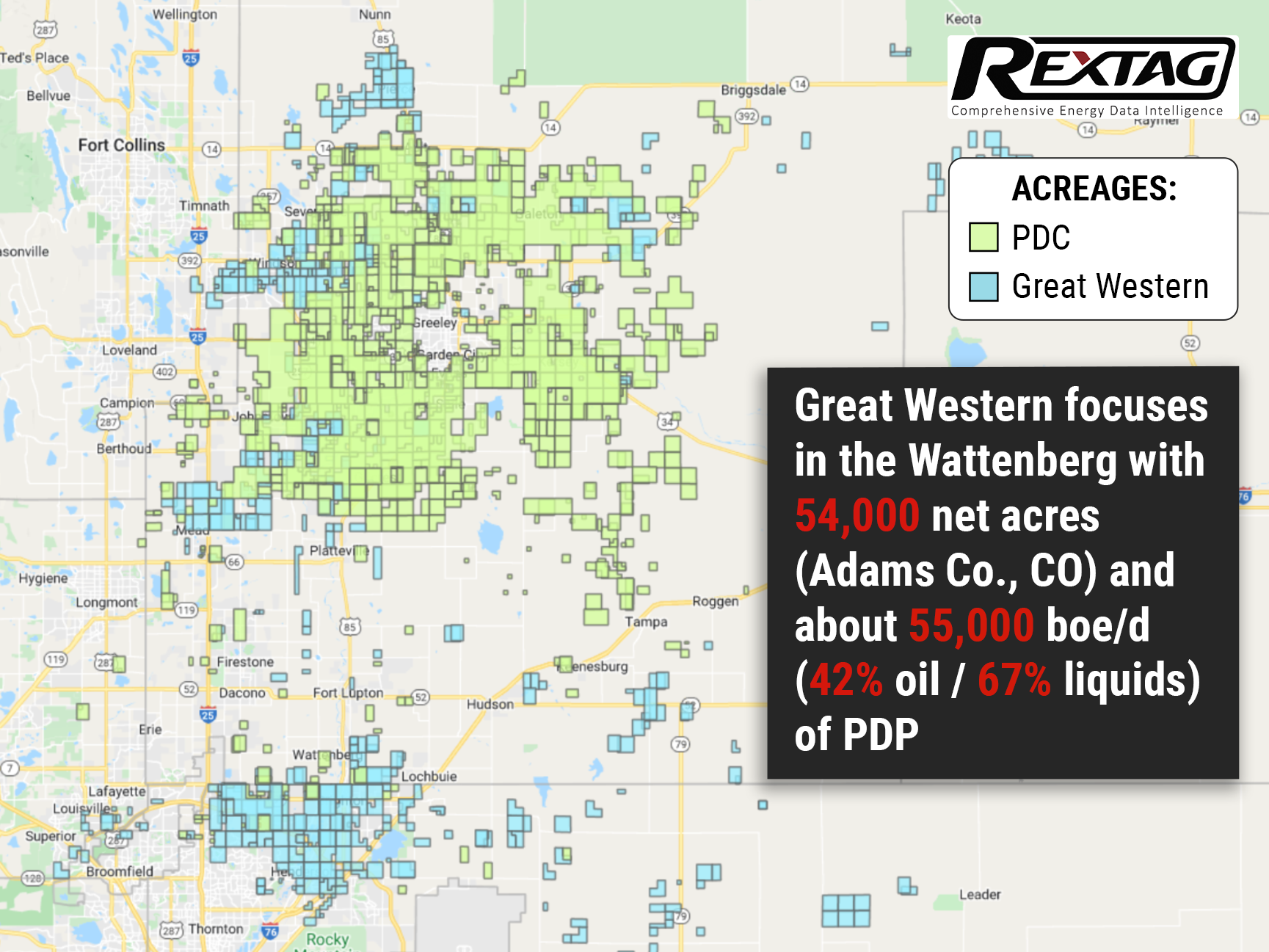

All Eyes Are on the Rocky Mountains State, as PDC Acquires Great Western for $1.3B

Great Western Petroleum's assets will be acquired by PDC Energy for $1.3 billion. Via this deal, PDC Energy’s position in the D-J basin increases roughly to 230,000 net acres. Denver-based Great Western has core operations in Weld and Adams counties in Colorado with 54,000 net acres and about 55,000 boe/d (42% oil / 67% liquids) of PDP. As part of the agreement, the acquisition will be financed by issuing 4 million shares of common stock to existing Great Western shareholders and by providing $543 million in cash to the company. All in all, PDC expects to increase its total production by 25% and its oil production by 35% as a result of the deal. The deal should also result in some synergies including a 15% reduction in overall cost per BOE.

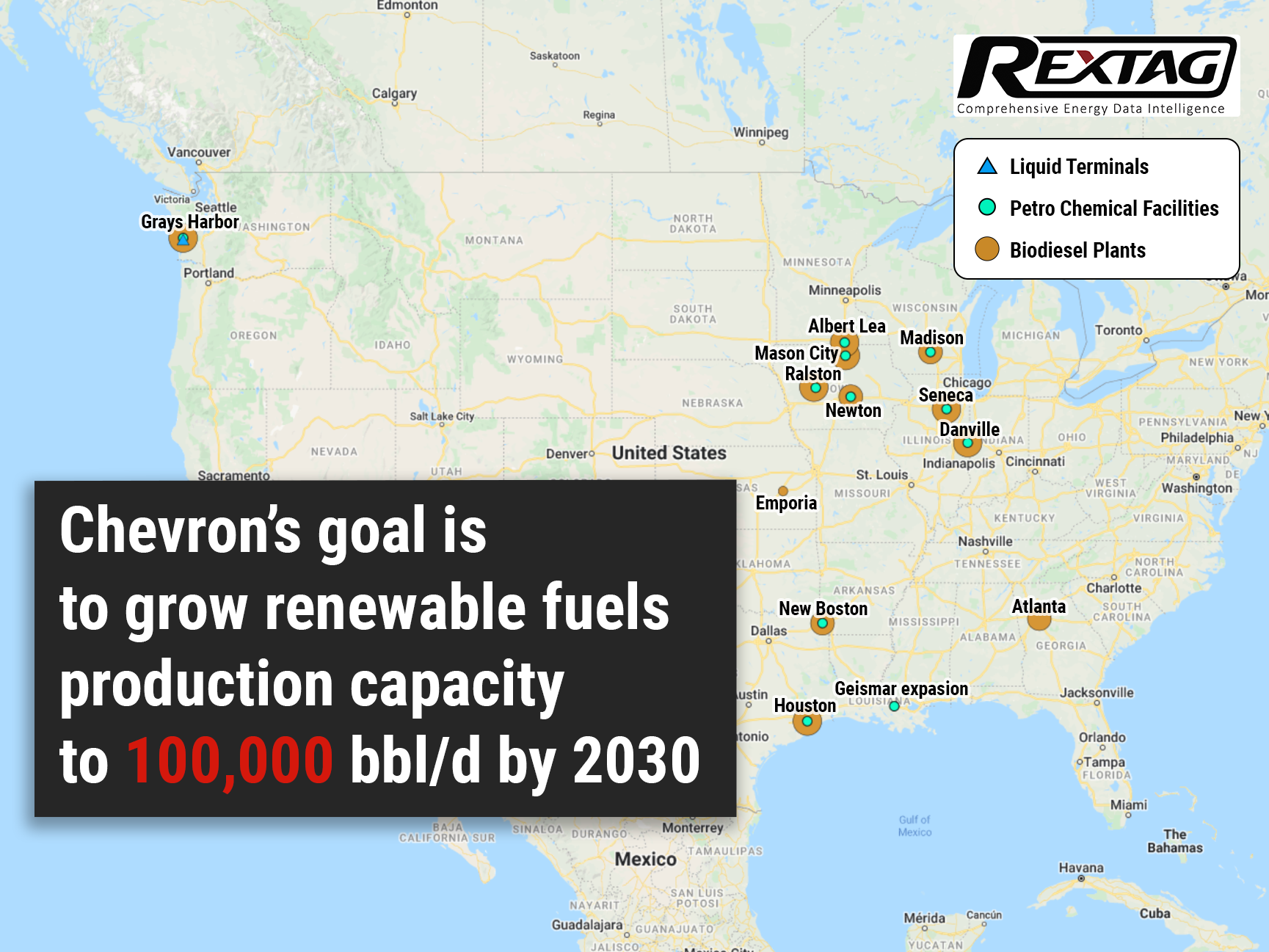

All-in: Chevron Invests $3 Billion in Alternative Fuels

With the purchase of Renewable Energy Group Inc. for $3.15 billion, Chevron makes its largest investment in alternativefuels. This turn in investments highlights the shift in the world’s attitude toward climatechange. Since oil companies contribute heavily to global #emissions, governments and investors are increasingly urging them to reduce their #carbonfootprints and join the fight against emissions. As state and federal subsidies to decarbonize fuels increase, U.S. refineries have likewise increased the production of renewable diesel. In line with this, by 2050, Chevron aims to cut gas emissions to zero.

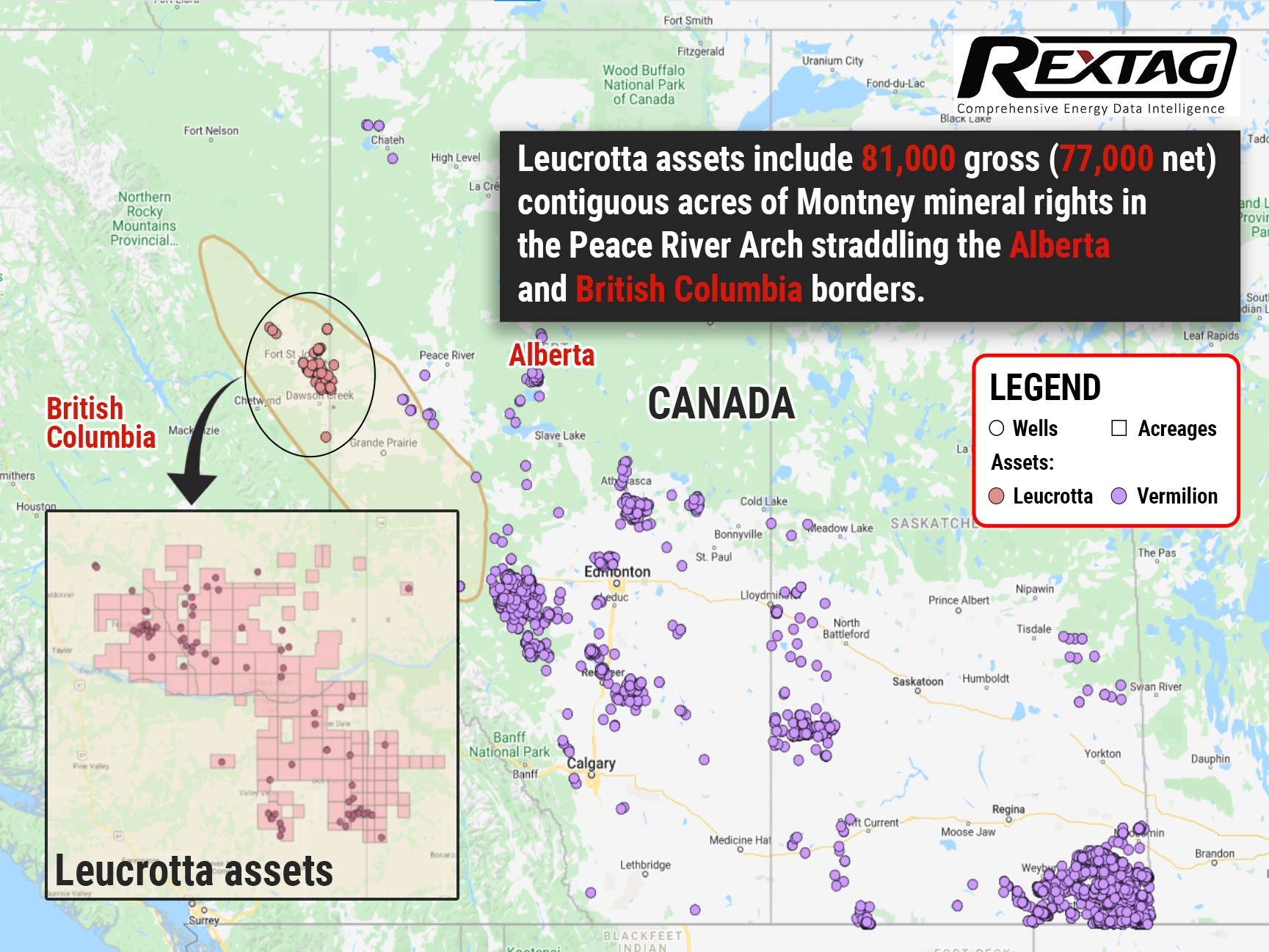

Decades of free inventory from one deal: Vermilion Energy buys Leucrotta Exploration for $477 million

As part of its effort to expand its Montney Shale play, Vermilion Energy Inc. recently acquired Leucrotta Exploration Inc. for a net cash purchase price of CA$477 million. Vermilion has identified 275 high-quality, high-return, low-risk multi-zone drilling prospects. Top management believes, these prospects represent 20 or more years of low-risk, self-funding, high-deliverability shale drilling. Assuming the anticipated May closing date, Vermilion is increasing its capital budget for E&D in 2022 to $500 million and increasing guidance for production from 86,000 to 88,000 boe/d to take into account the Leucrotta acquisition.

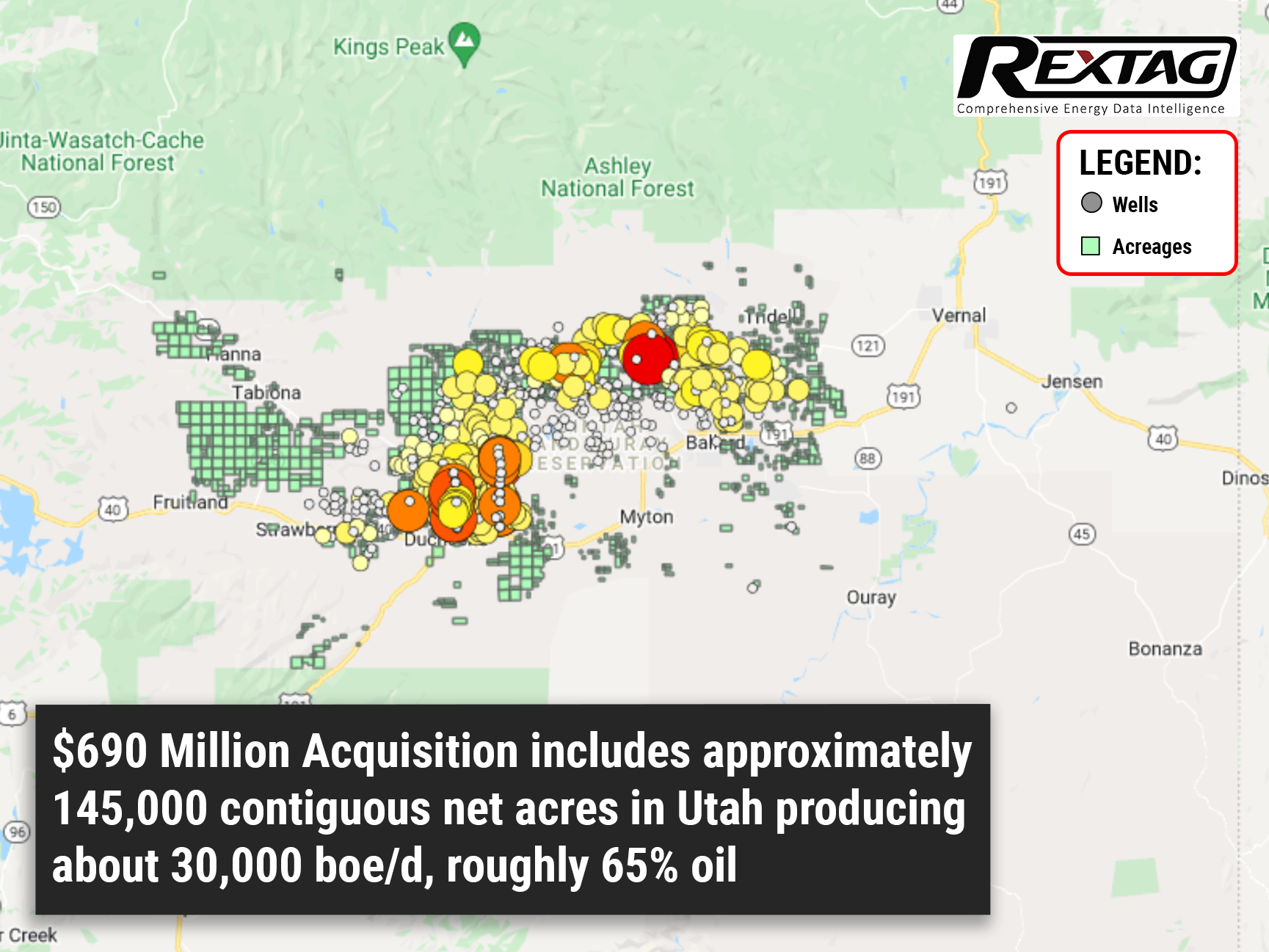

$690 Million Deal Moves Ahead: Crescent Energy to Complete Purchase of EP Energy's Uinta Assets

Crescent Energy closed the acquisition of Uinta Basin assets in Utah that were previously owned by EP Energy for $690 million, a few hundred million dollars below the original price. The accretive deal increases Crescent's Rockies position and adds significant cash flow and a portfolio of high-quality oil-weighted undeveloped sites. In addition to its acquired Uinta assets, Crescent's pro forma year-end 2021 provided reserves totaled 598 million boe, of which 83% was developed, 55% was liquid, and its provided PV-10 was $6.2 billion.

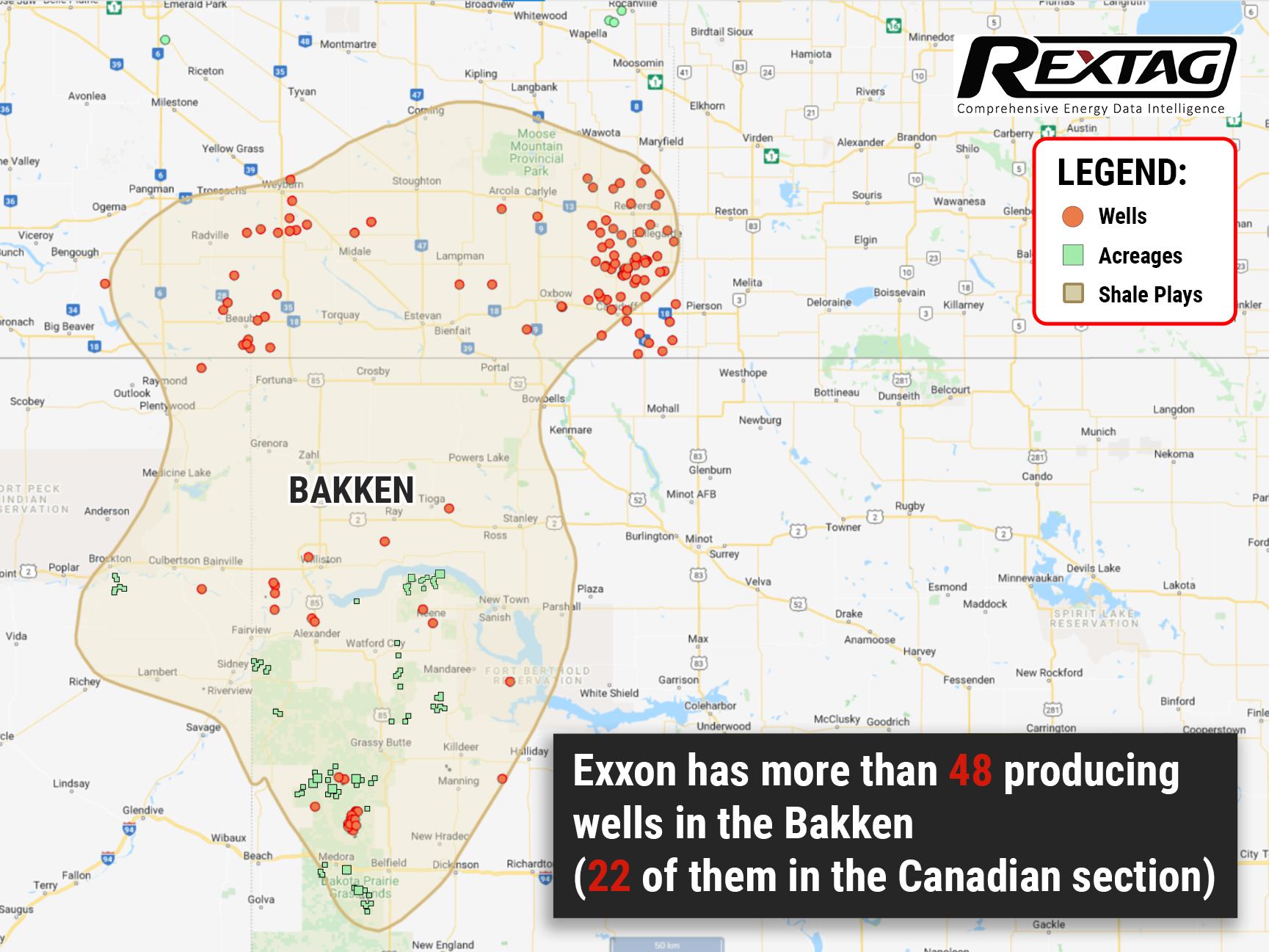

To Be or Not To Be: Bakken Assets Could Fetch $5 Billion for Exxon Mobil

Exxon Mobil Corp. is weighing prospects of selling its assets in North Dakota’s Bakken, after gauging interest from potential buyers — 5 billion is the issue price, at least according to rumors. The price point came about after the news that the oilgiant is in the final round of hiring bankers to help launch the sale. Yet Exxon Mobil itself stays tight-lipped regarding the situation.

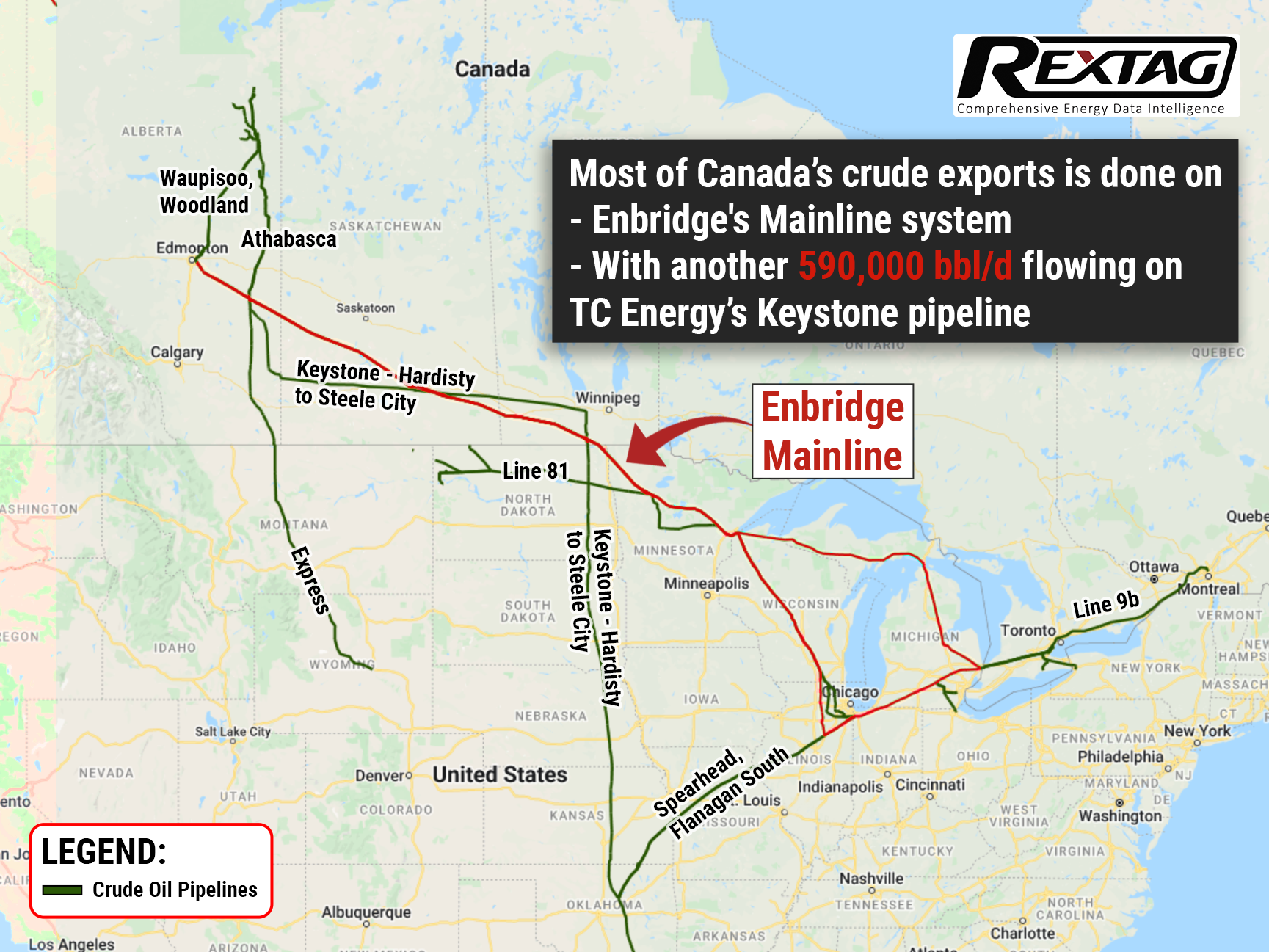

As Countries Shun Russian Crude, Canada Plans to Boost Its Oil Exports

Canada is looking at ways to increase pipeline utilization to boost crude exports as Europe seeks to reduce its reliance on Russian oil At the moment, oil exports from Canada to the U.S. are approximately 4 million barrels of oil per day, with a portion reexported to other countries. At the end of 2021 Canadian oil companies exported a record amount of crude from the U.S. Gulf Coast, mostly to big importers India, China, and South Korea. And this will only increase in the future.

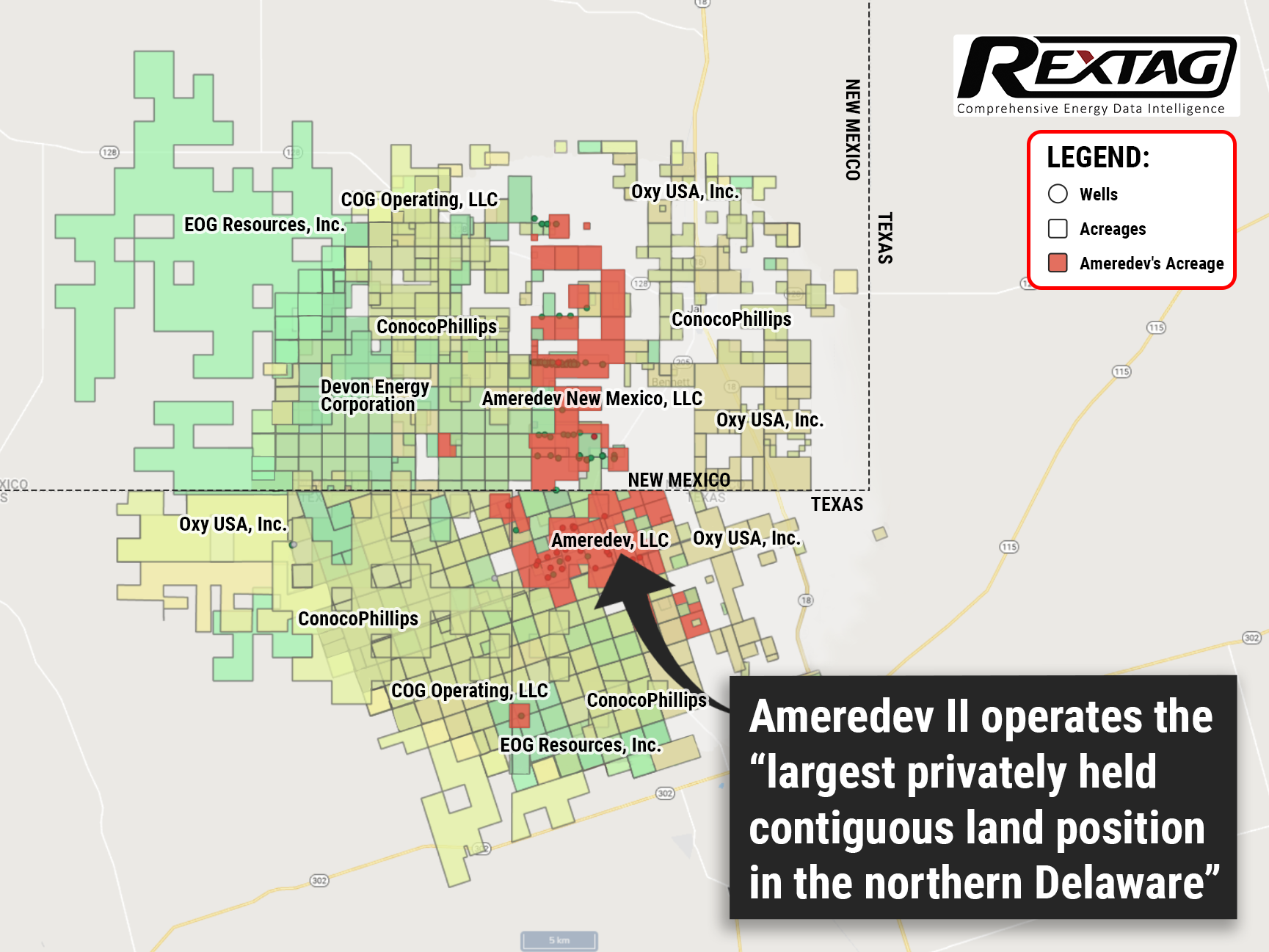

Major: Ameredev II Oil Producer to be Sold for $4 Billion by EnCap

In light of the conflict in Ukraine, buyout firms are currently scurrying to make cash from the U.S. crudeprices reaching their highest level since 2008. And one of the largest privately-owned US-based oilproducers may be up for sale. EnCap Investments looks to sell its portfolio company Ameredev II for over $4 billion including debt. It’s important to note, however, that both EnCap and Ameredev II alike are staying tight-lipped on the matter.

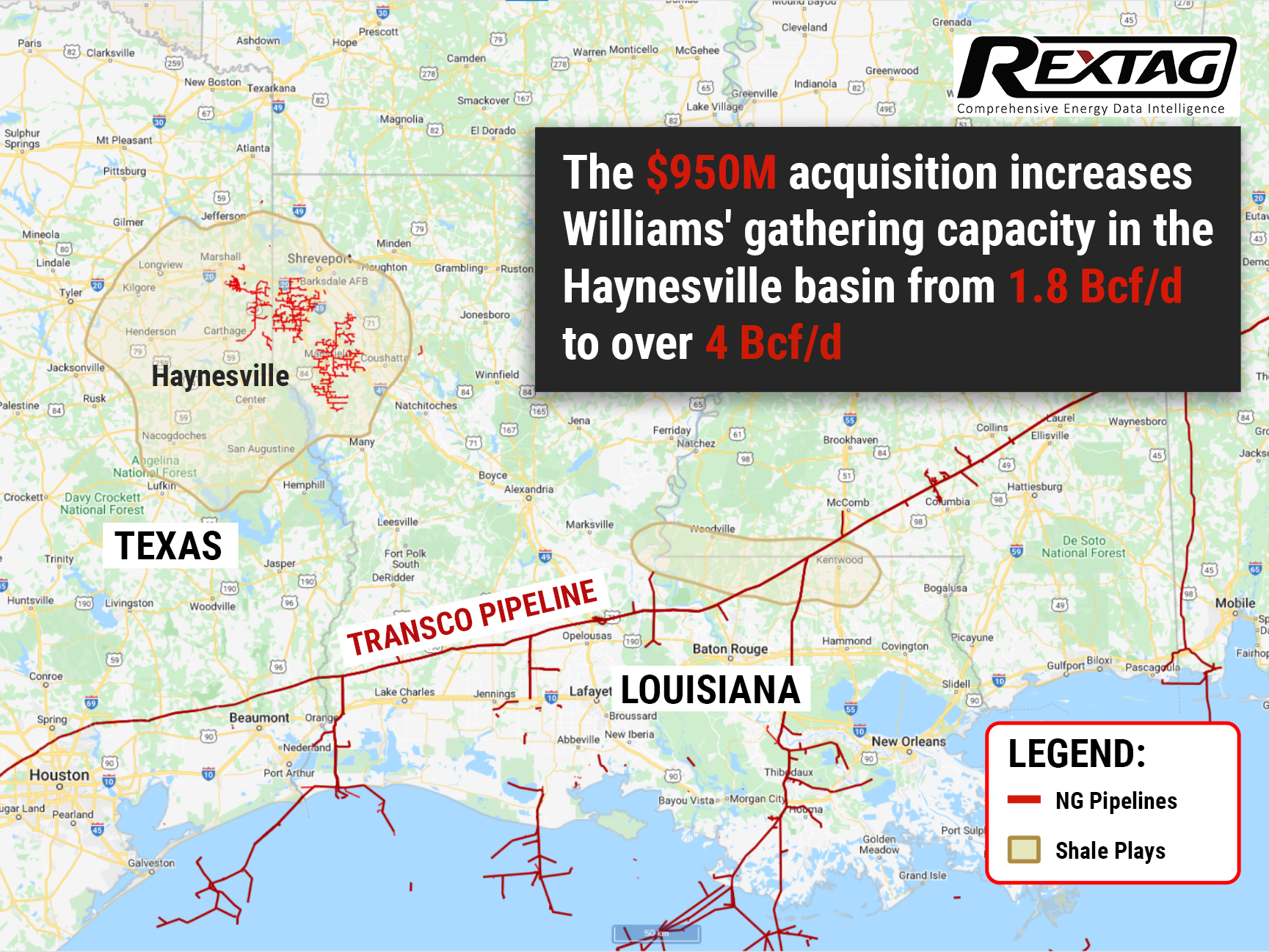

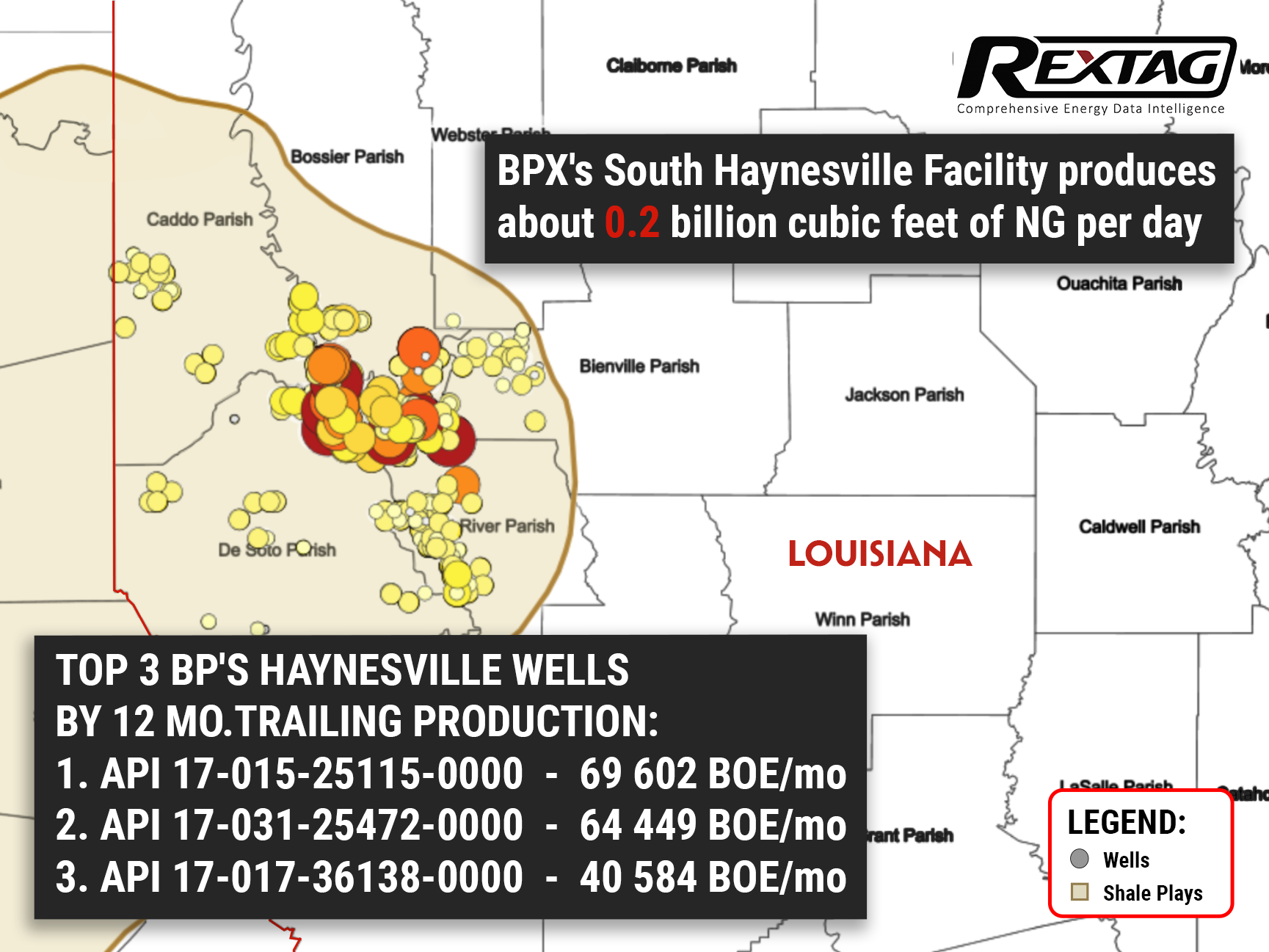

$1B Deal: Williams Buys Out Houston-based Midstream in Haynesville Basin

By purchasing the gathering and processing assets of Trace Midstream, Williams' existing footprint gains expanded capacity in one of the nation's largest growth basins, bringing its Haynesville gathering capacity to over 4 Bcf/d — increasing more than 200% from 1.8 Bcf/d. The deal also includes a long-term commitment from Trace and Quantum to support Williams' Louisiana Energy Gateway project (LEG), which is aimed to deliver responsibly sourced Haynesville’s naturalgas to markets along the Texas and Louisiana GulfCoast

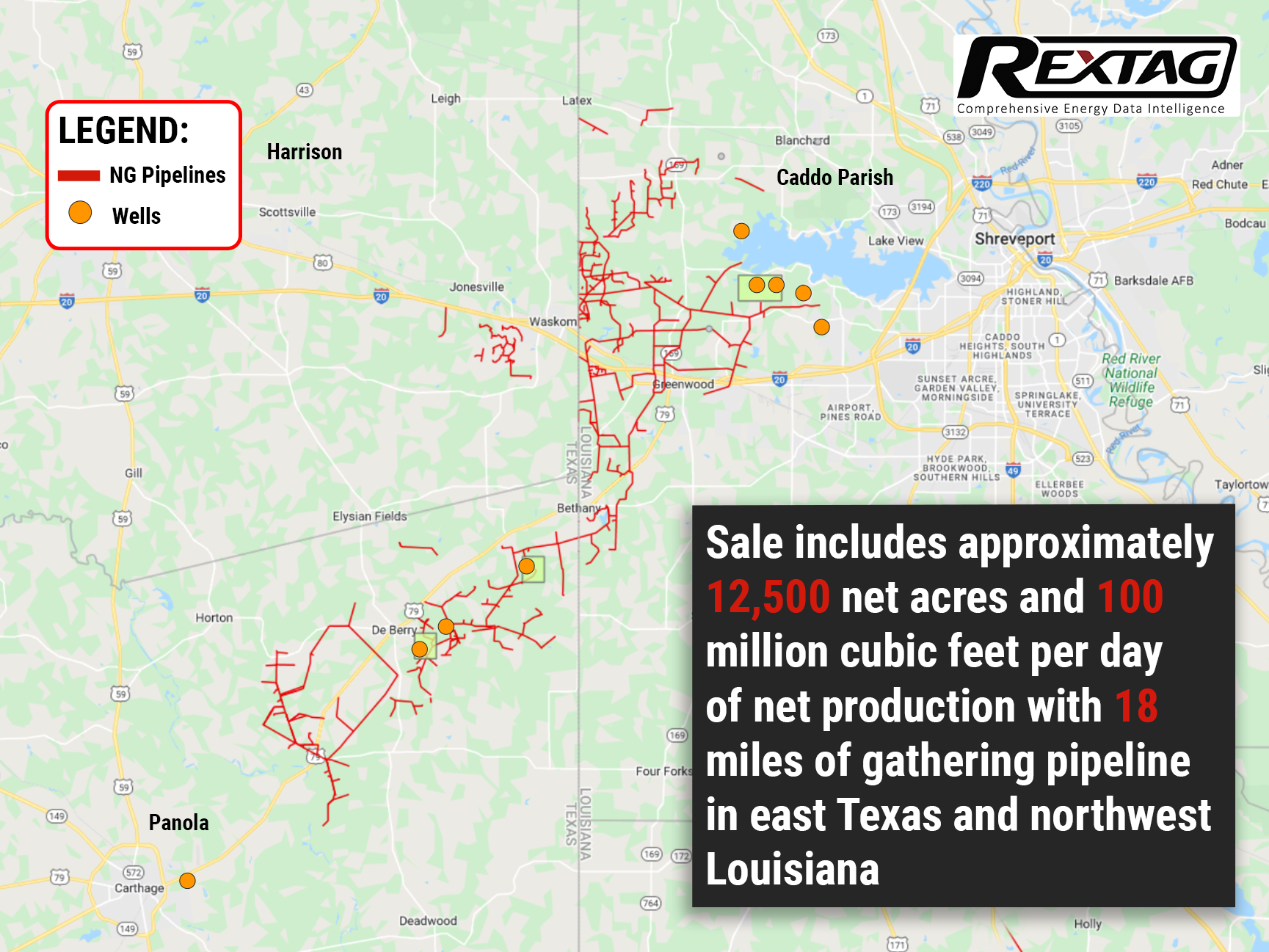

Pine Wave Energy and Silver Hill Reached an Agreement Over Haynesville Assets — Deal is Sealed

Looks like Pine pulled the plug on its properties in Caddo Parish, Louisiana, and Harrison and Panola counties, Texas. Which includes a total of 12,500 acres and ownership interests in 10 operated wells with a production capacity of 100 million cubic feet per day along with 18 miles of naturalgas gathering pipelines. Did Pine just give up on Haynesville?

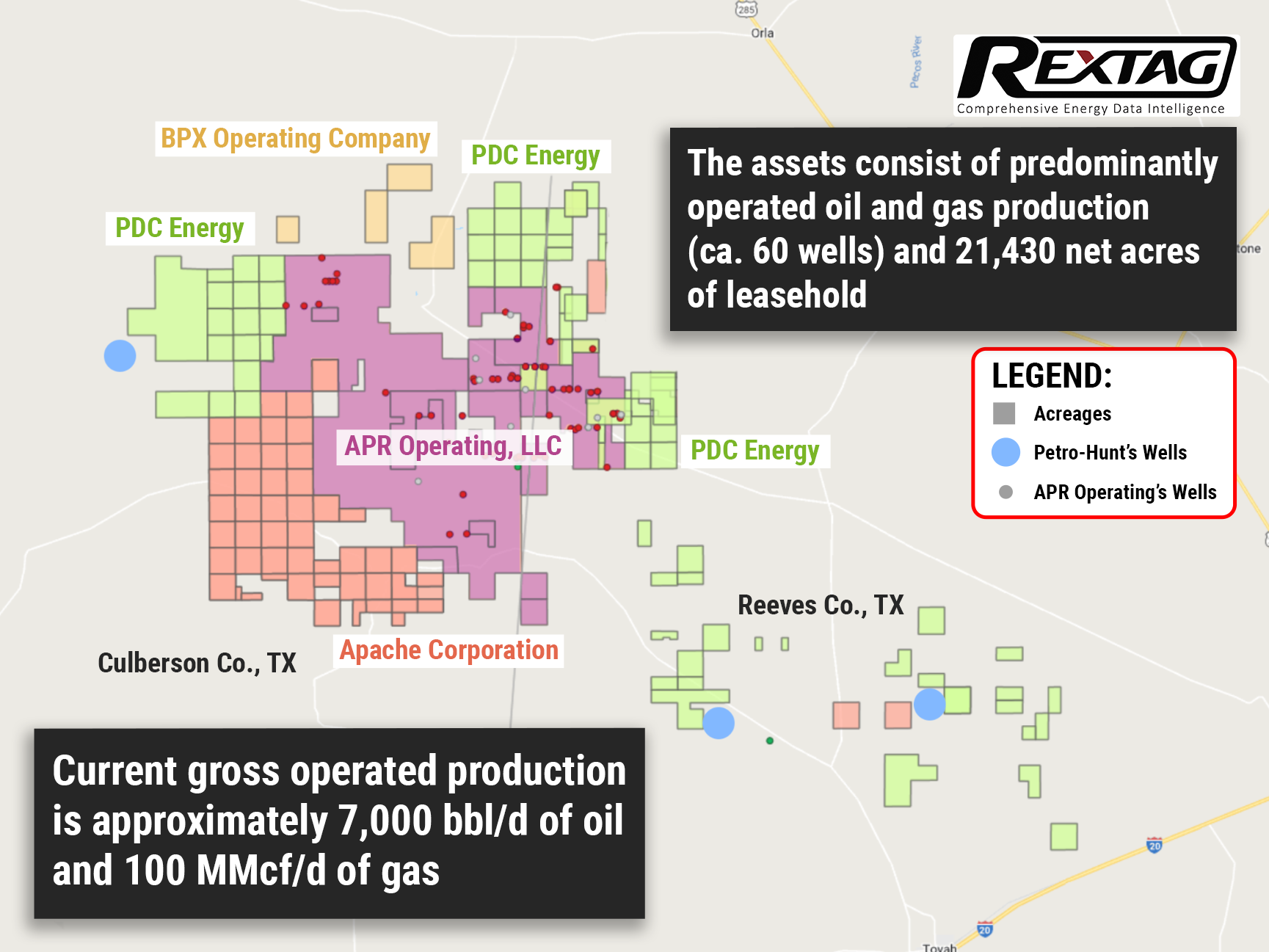

Winds of Change: Admiral Sold Its Assets in Delaware Basin

And Petro-Hunt E&P is the new sheriff in town with 21,430 net acres of leasehold in the Basin, production of which surpasses 7,000 bbl/d and 100 MMcf/d respectively. To take advantage of it, Petro-Hunt plans to begin an active development drilling program on these assets in the coming months heavily upgrading the numbers of its 775 operating oil wells and contributing to over 8,100 non-operated wells. Time will tell, however, whether or not this move will be able to deliver such results.

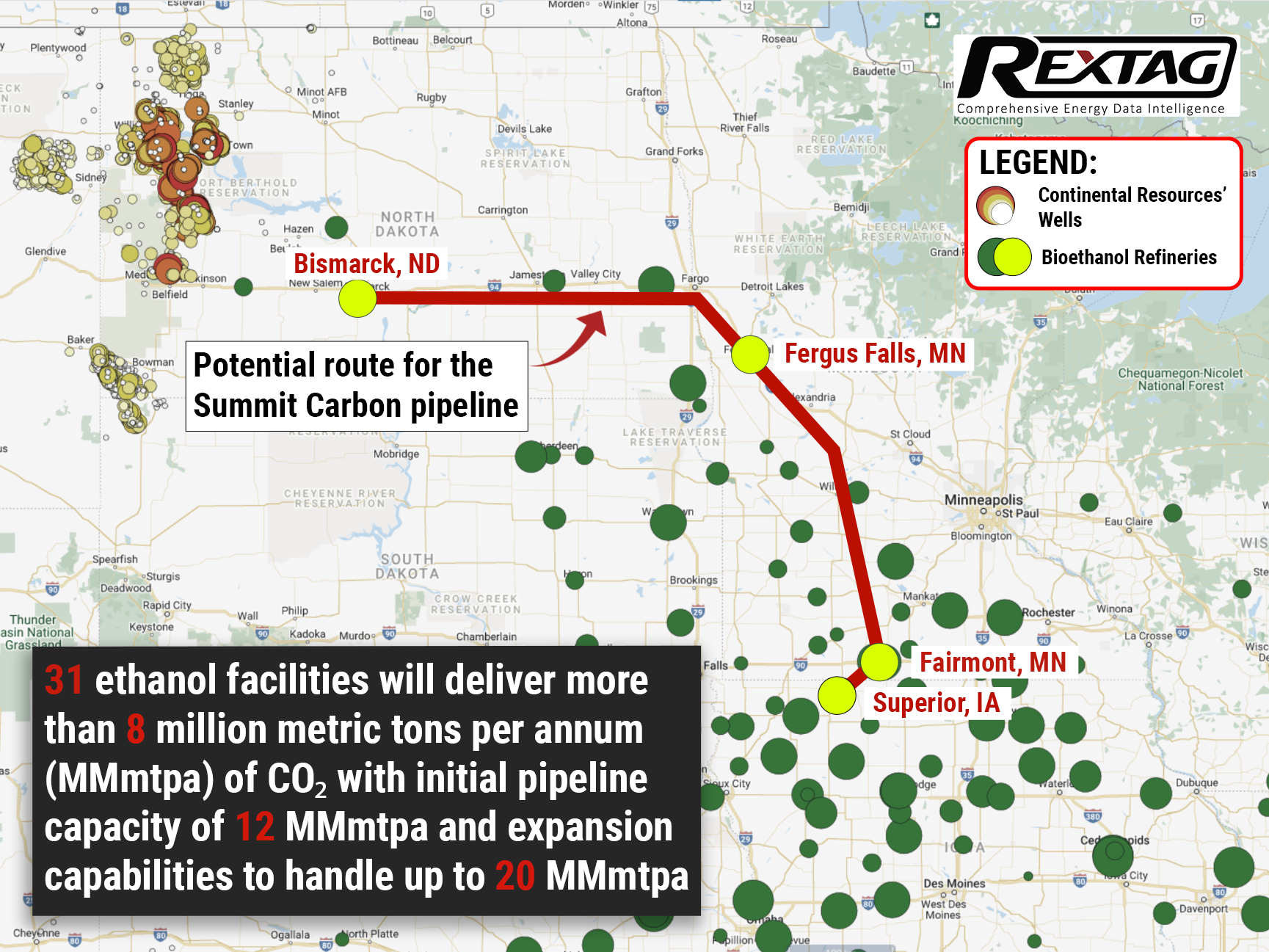

Continental Resources Inc. Invests a Quarter of a Billion Dollars in a Sequestration Project in North Dakota

The investment will happen in the next 2 years. The project intends to capture CO2 from ethanol plants and other sources in Iowa, Nebraska, Minnesota, North Dakota, and South Dakota. Upon aggregation, CO2 will be transported via pipeline to North Dakota, where it will be stored in subsurface geologic formations. The formations will be in the Williston Basin, where Continental Resources has been a dominant producer for more than half a century. At the moment it’s the world's most ambitious carboncapture venture of its kind. The sequestration itself should be underway by spring 2024.

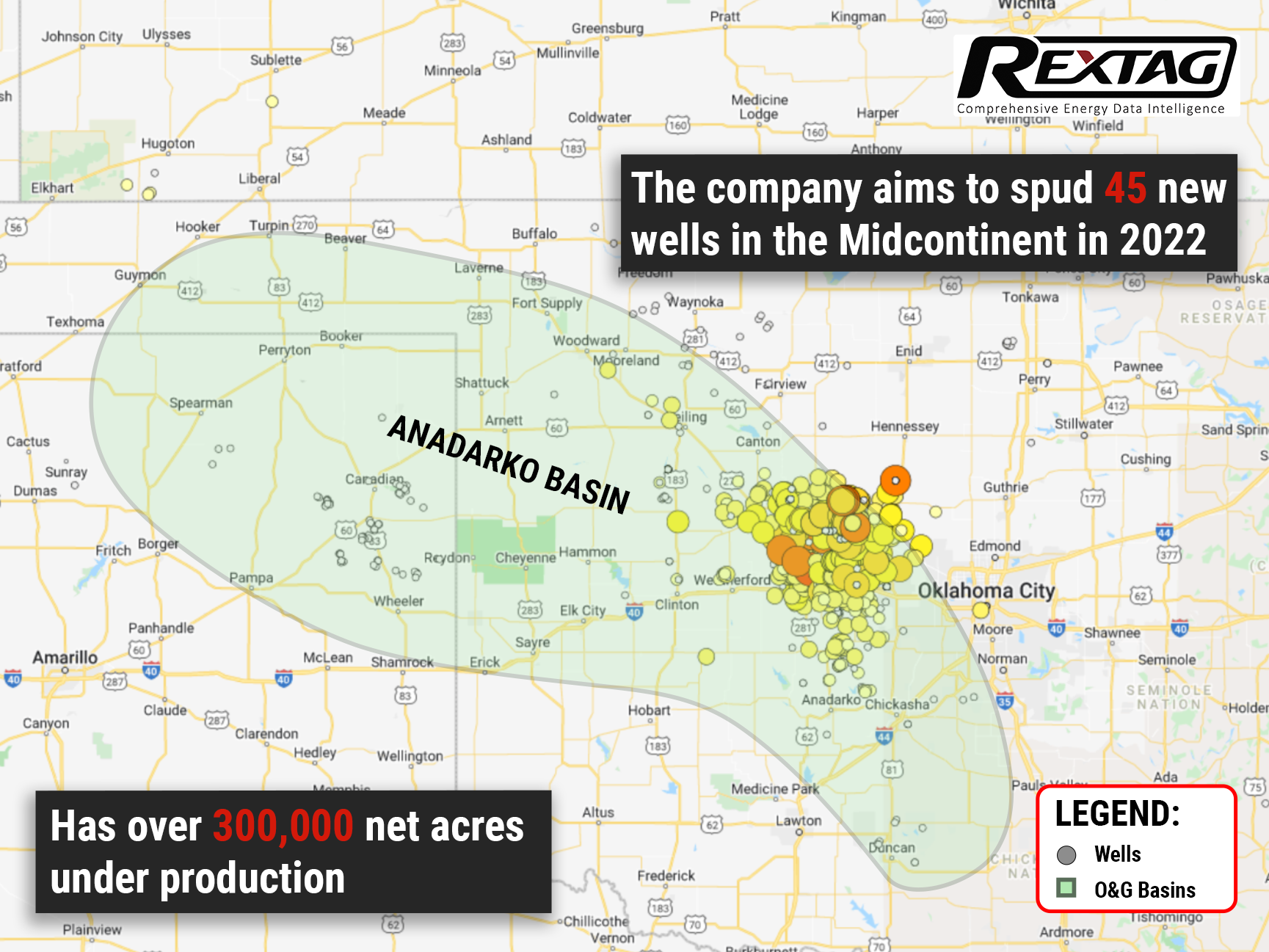

All In: Devon Energy is Banking on a Rebound for Anadarko

Devon Energy Corp. believes that the Anadarko Basin is a hidden treasure and aims to use its position in it to fuel a robust cash return model and establish itself as an industry leader in promoting ESG. This E&P company plans to drill 45 new wells in the Midcontinent by 2022, as well as to produce 600,000 boe/d across five operating basins, including the Eagle Ford Shale, Permian, Powder River, and Williston basins. And given that Devon's recent fourth-quarter results were better than Street estimates. It appears that they are doing something right, at least for the moment.

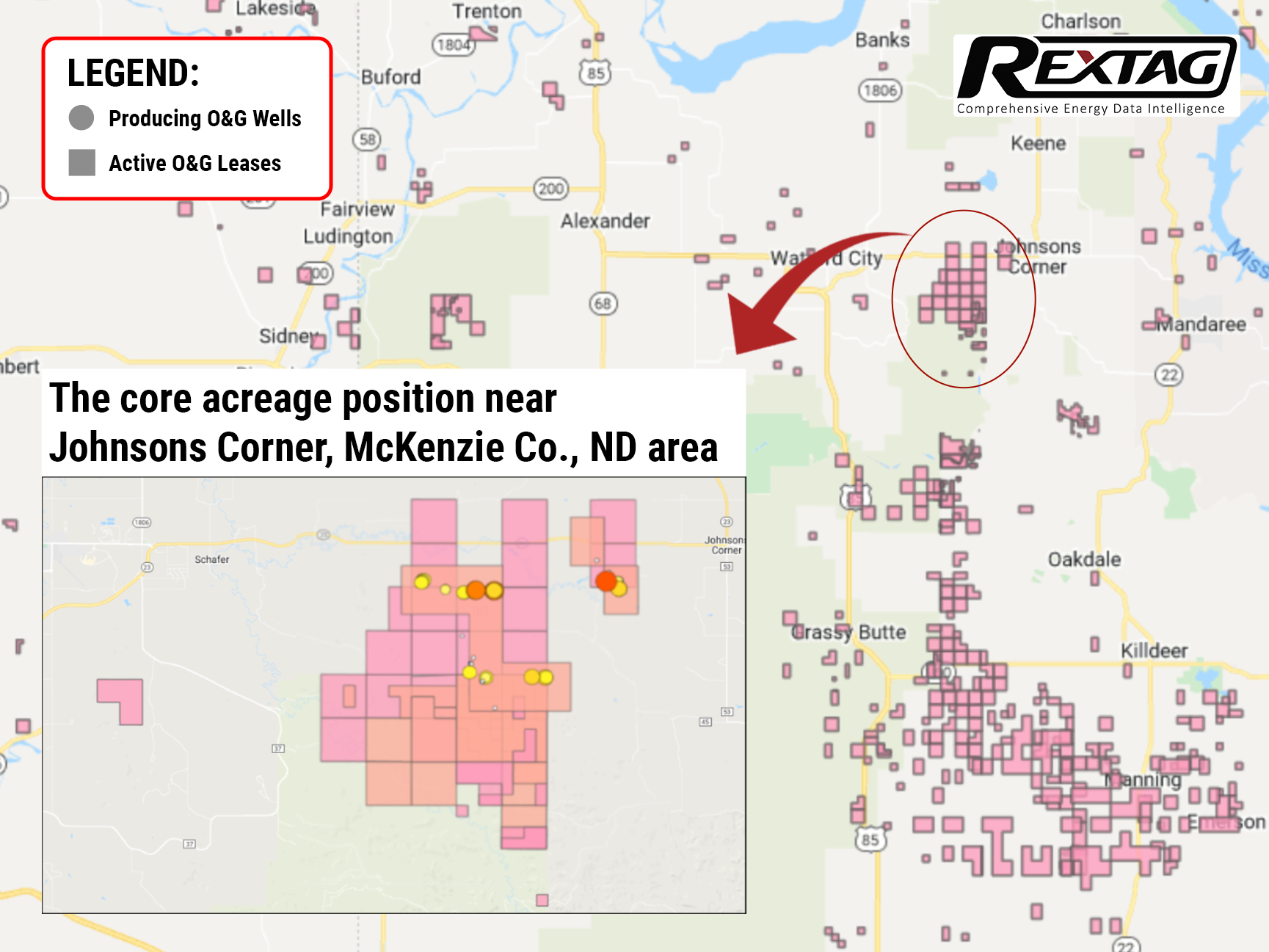

Lime Rock Resources Starts the Year With a Bang — a Money Bang!

Still waters run deep: after patiently waiting for 2 years, Lime Rock Resources starts the year with a pair of acquisitions worth $358.5 million The two acquisitions include Abraxas Petroleum’s Williston Basin position in North Dakota: about 3,500 acres of land and 19,400 boed of net production, as well as properties situated in Burleson, Milam, and Robertson in Texas from a third party, that contain 46,000 contiguous net acres and produce 7,700 boed as of the closing of the deal. The company intends to intensify its focus on low-risk opportunities and margins, which will significantly boost Lime’s market position going further.

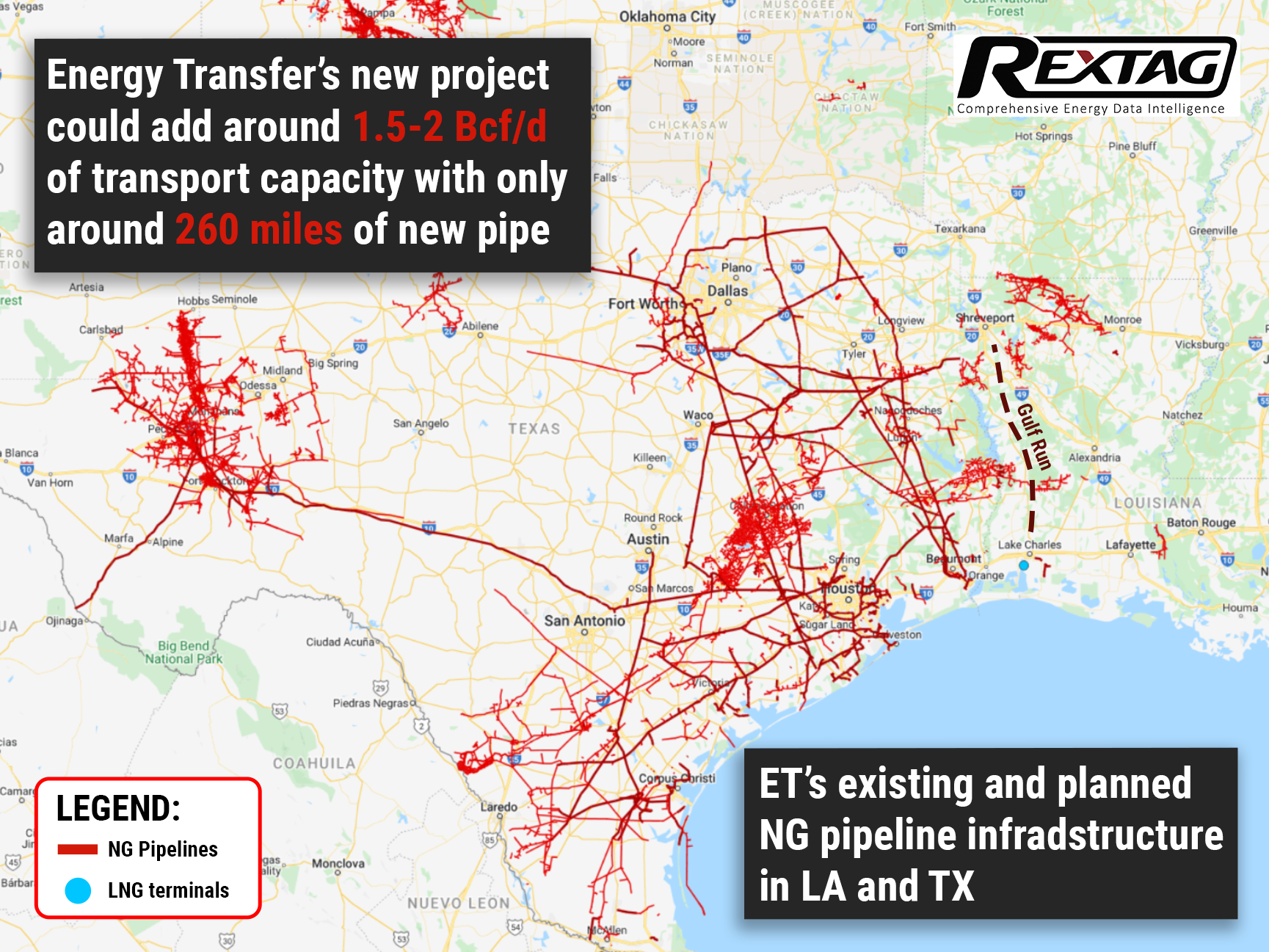

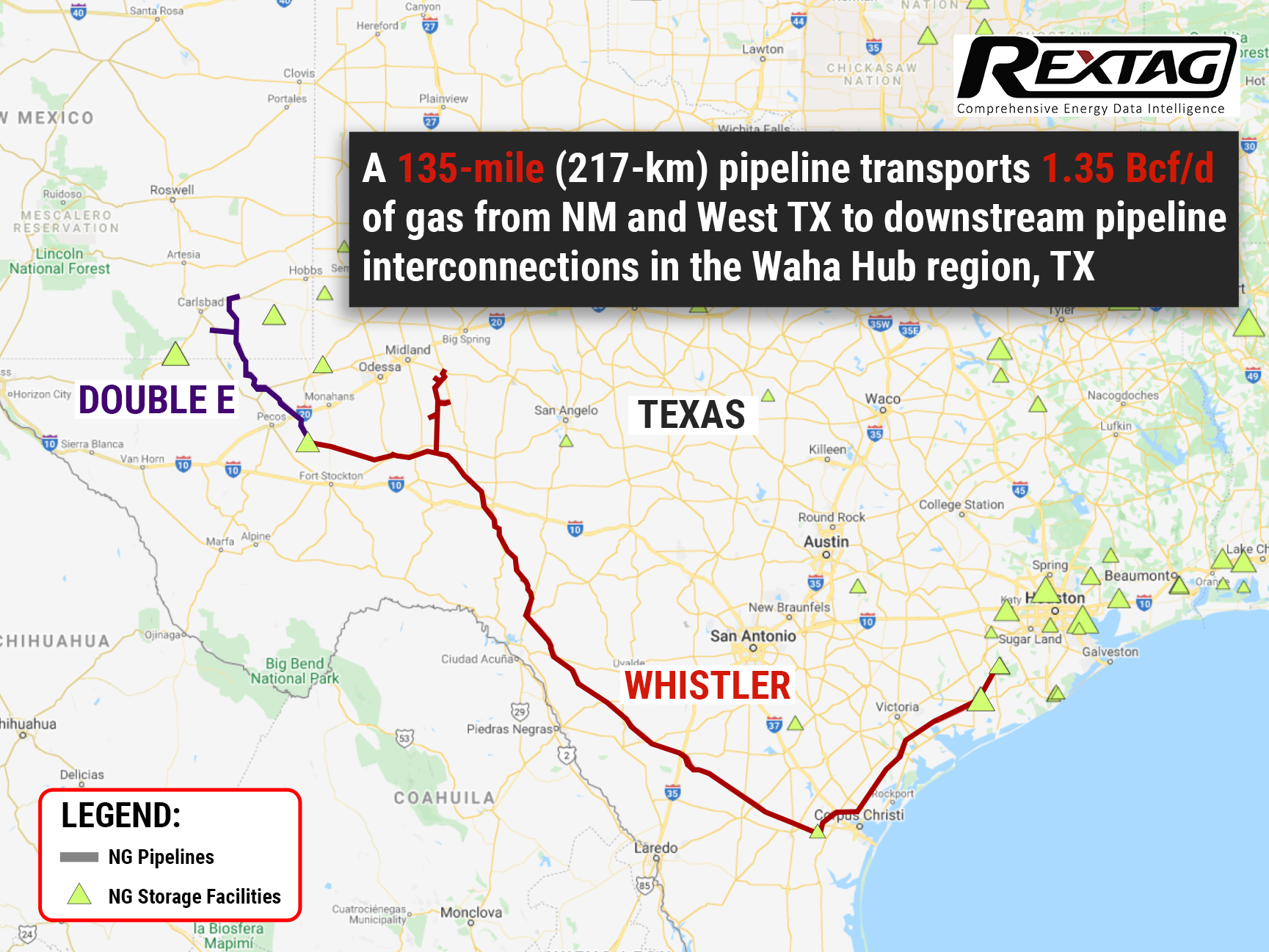

Energy Transfer LP Races to Carry Permian Basin Gas to Gulf Coast Hubs

The ever-increasing demand for natural gas exports from the Gulf Coast started a race to further develop Permian Basin. Various companies, including Kinder Morgan and MPLX, are among those looking at building new pipelines in the region due to the demand spike. But Energy Transfer seems to edge past them into the lead since its project strikes as the most economical option for the basin outside of capacity expansions on existing pipelines and could essentially add 1.5-2 Bcf/d of transport capacity with just 260 miles of new pipe.

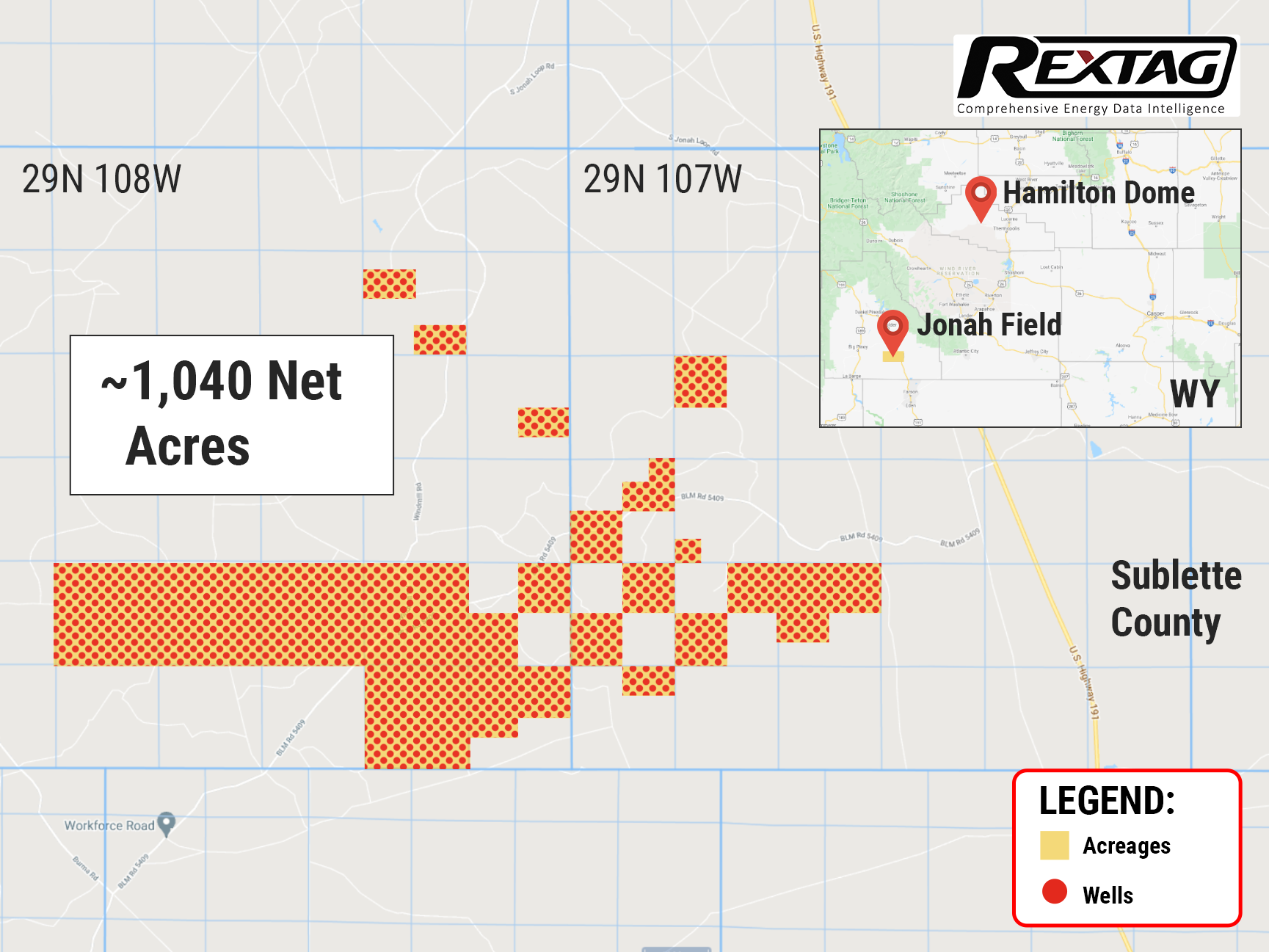

Evolution Acquires Non-operated Wyoming Natural Gas Interests

Evolution Petroleum just spend a fortune on Jonah’s Field right after acquiring Hamilton Dome Field in Wyoming. The price of the transaction is $29.4 million. The Houston-based company aims to diversify into natural gas assets, providing access to the western markets through the Opal market hub, with the optionality to flow to the east. That transaction took effect on February 1. We anticipate closing on or about April 1.

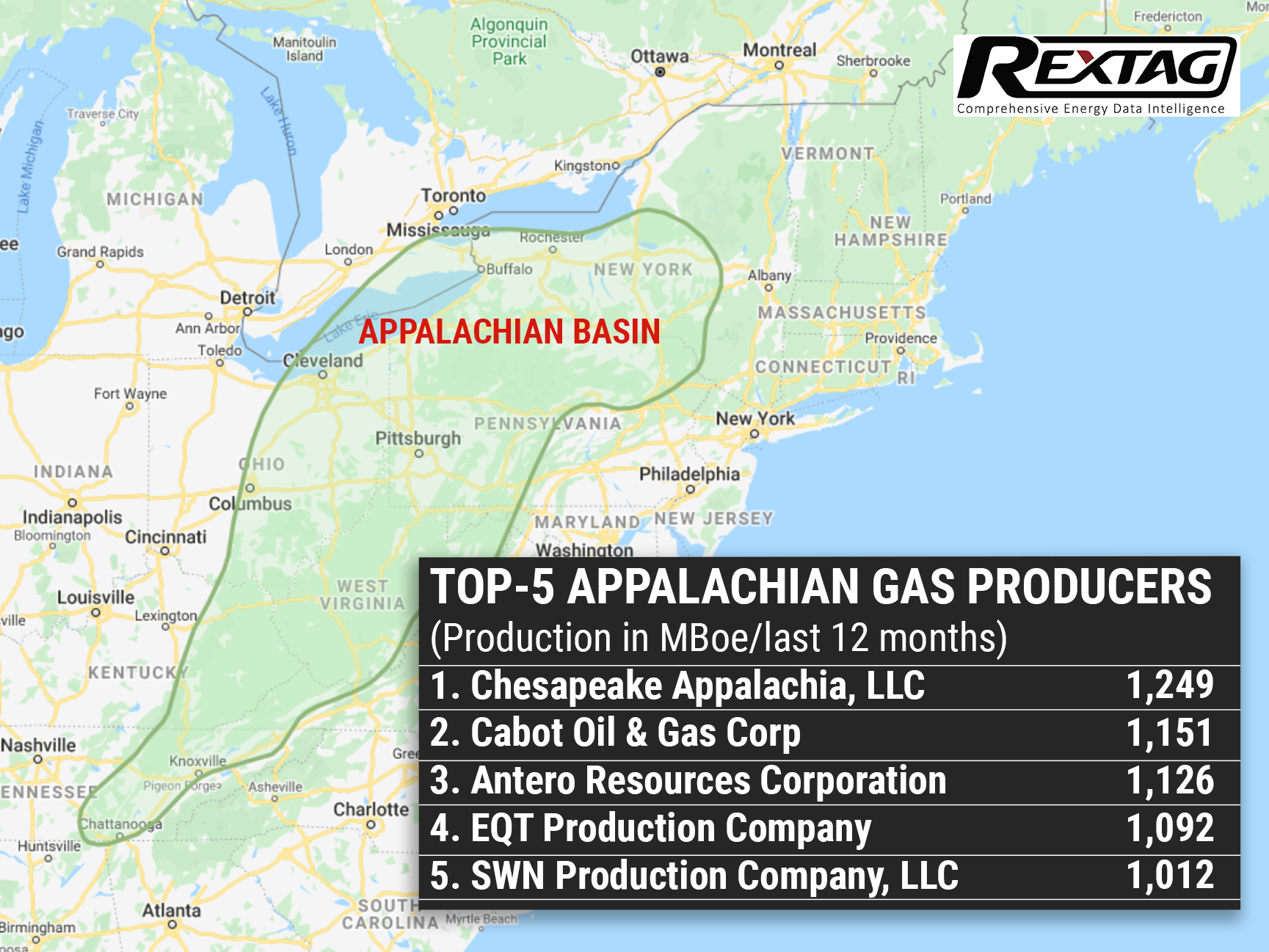

Look At The Future Of American And Appalachian Gas Production

The crux of the matter is rather simple: productivity gains of local energy operators have been stable not only because they are drilling better acreage, but also because players finally realized capital efficiency gains. And even if some new obstacles impede Appalachia's growth at the same rate as the Permian or Haynesville, it does not detract from the value of the Marcellus and Utica basins. The Appalachians will still be the top producers at a very competitive pace as long as commercial inventory exists. After all, as long as there is commercial inventory, somebody will have to drill.

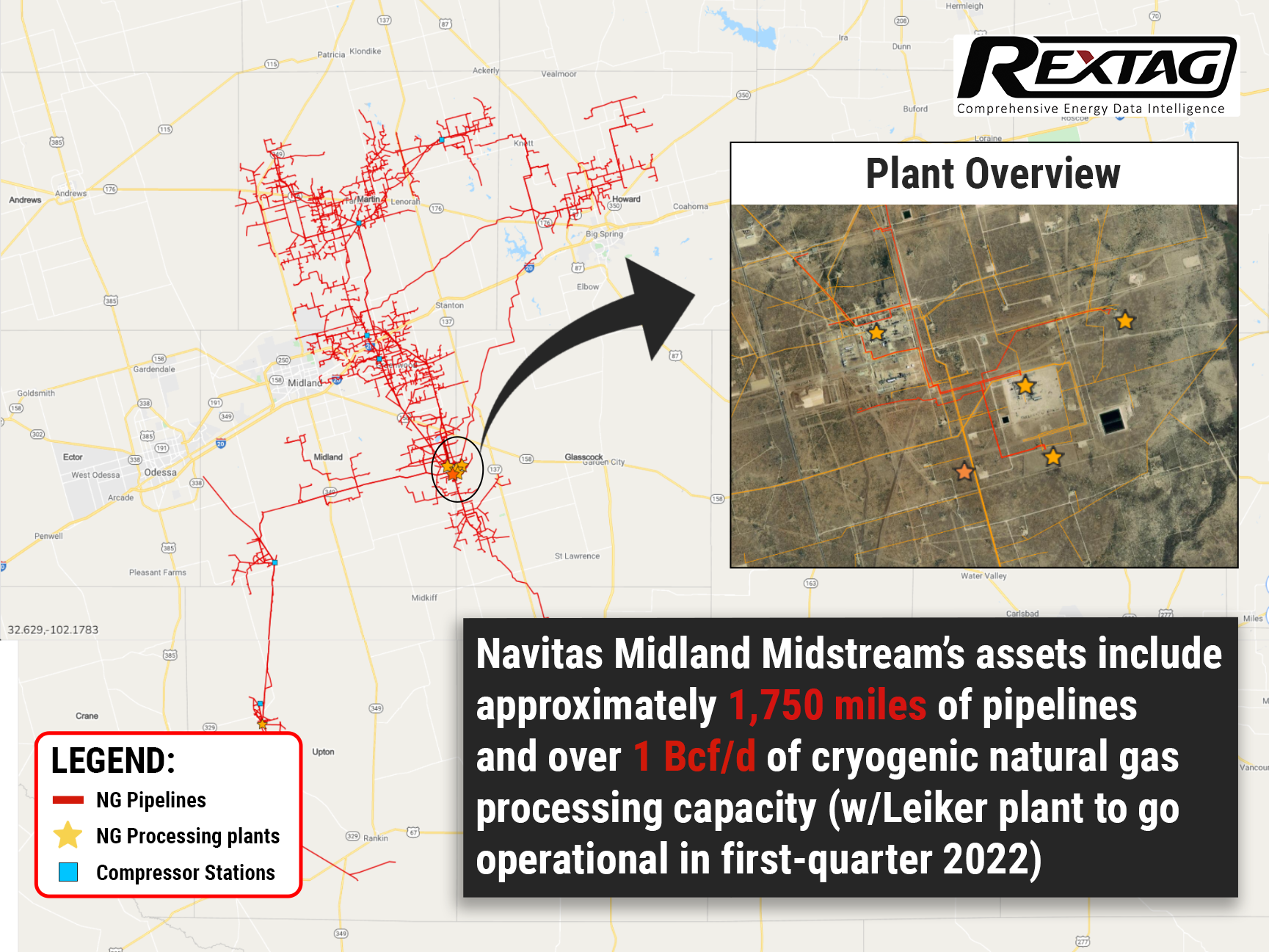

Enterprise acquires Navitas Midstream for $3.25 billion in cash

Enterprise decided to go in on the Permian Basin. With the surprise purchase of Navitas Midstream for $3.25 billion in cash, the company gained a foothold in the Midland Basin, as it previously lacked #naturalgas or NGL infrastructure apart from downstream pipelines in the region. Enterprise estimates that distributable cash flow accretion will be in the range of $0.18 to $0.22 per unit in 2023, while simultaneously supporting additional capital returns to their limited partners through distribution growth and buybacks of common units.

Colgate Energy's owners are planning to go public

Colgate Energy is planning to float its shale oil producer in the Permian's Delaware Basin on the stock market. If successful, this IPO would be the first major U.S. oil producer offering since Jagged Peak Energy's IPO in January 2017. Looks like investors’ confidence in the sector is returning as U.S. crude prices hit their highest in seven years late last year S&P energy index delivered roughly twice the return of the S&P 500 in 2021.

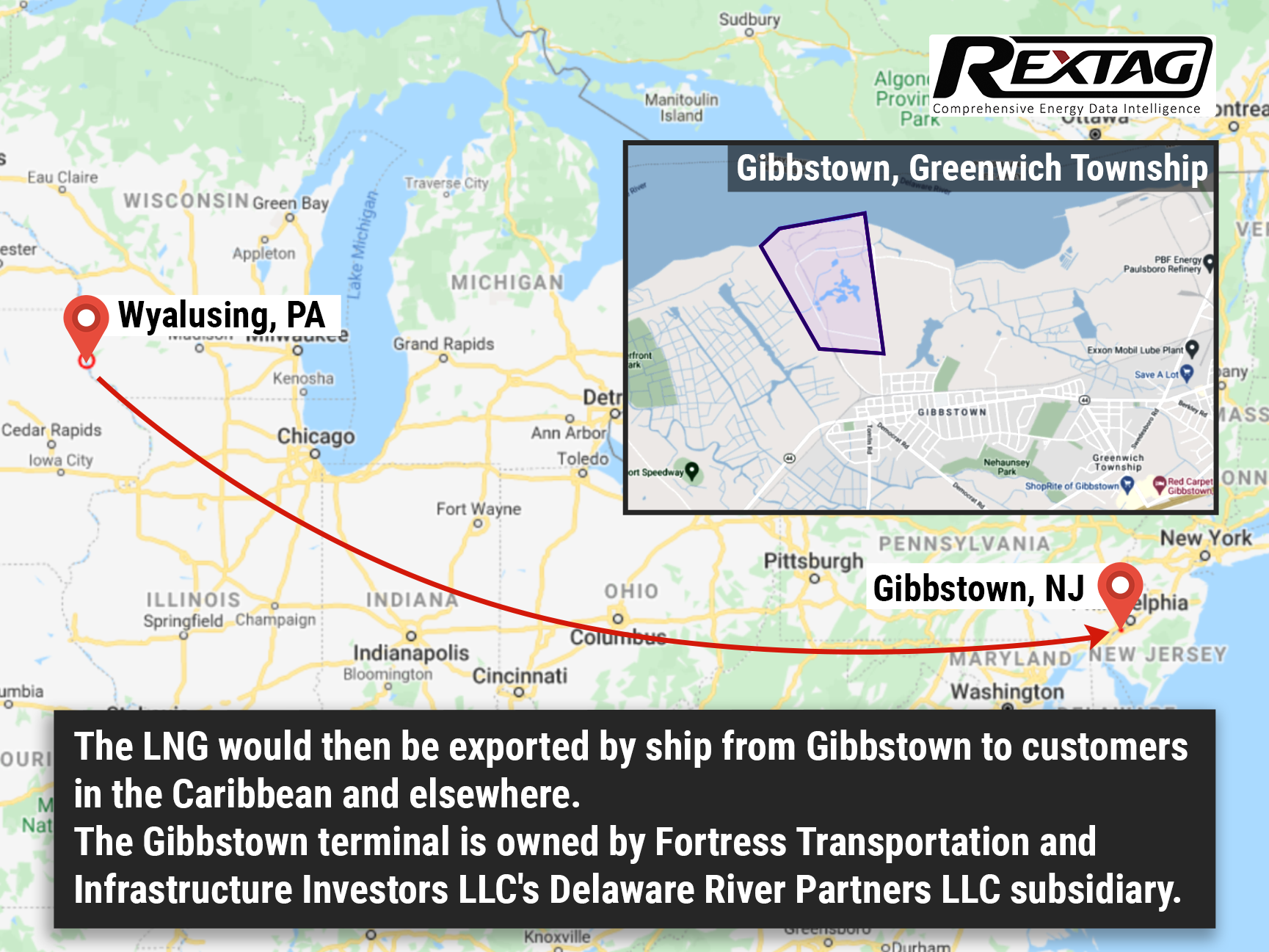

Rail Permit for New Fortress to Ship LNG Expired, Putting Future Projects at Risk

Uncertainty grows: as New Fortresses permit to ship LNG by rail expires, PHSMA explores temporal pausing of the method to provide more time to study safety-related issues. The news prompts one to wonder whether Fortress will proceed with its Pennsylvanian LNG project, in which it has already sunk about $159 million in development.

No More Gas Flaring: the Permian's Double E Pipeline is brought into service in West Texas

Permian Basins gas infrastructure boom: Summit Midstream puts into service a new pipeline system, aimed at reducing gas flaring in the area. Besides ecological concerns, the project will also transport almost 1,5 billion cubic feet of gas per day — enough to supply 5 million U.S. homes every day. According to Federal Energy Statistics, the project cost a whopping $450 million.

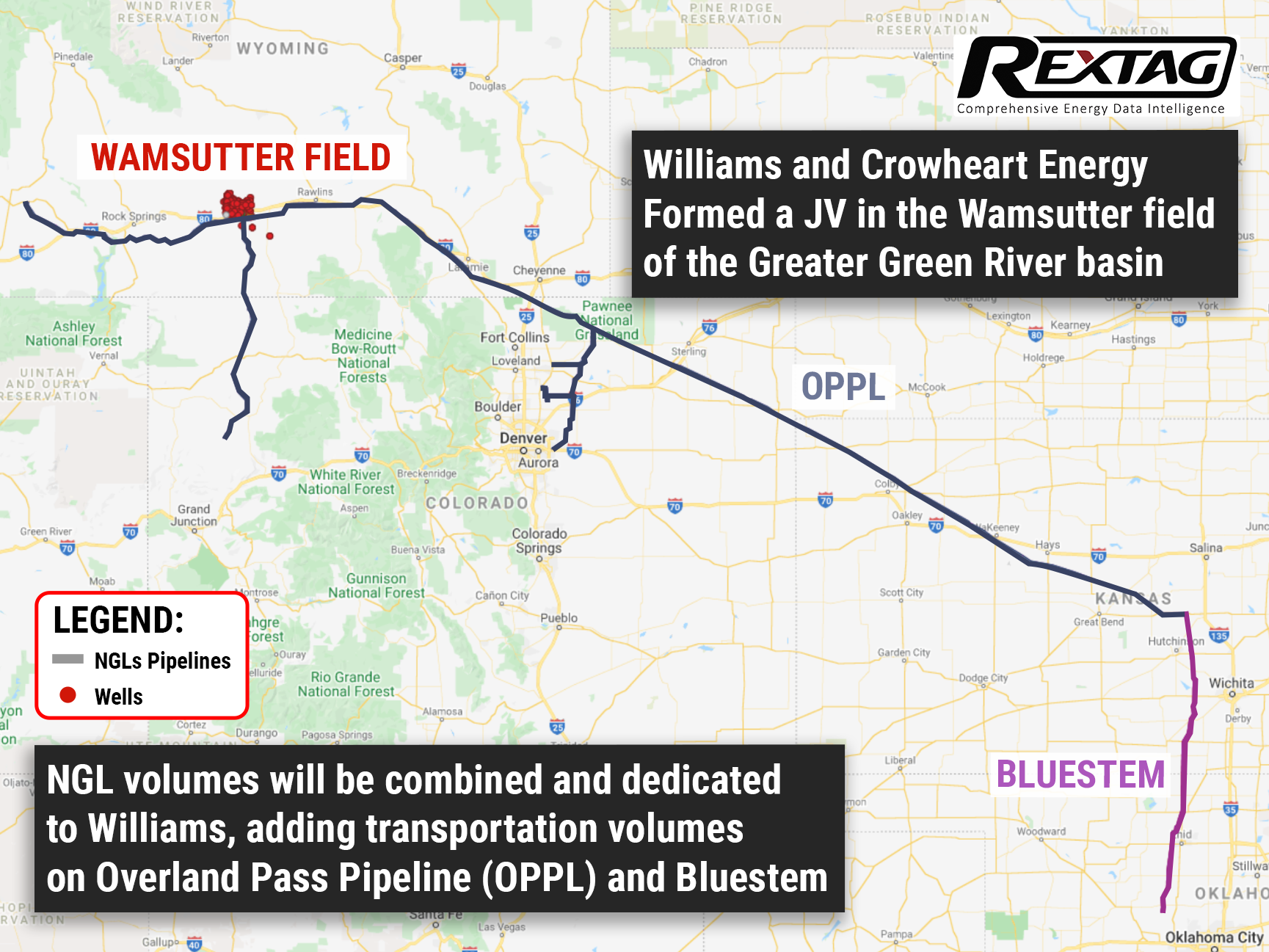

Smart Investments Are The Key To Success: Williams JV Brought Benefits At The End Of The Year

Williams boasts its Q3 results. With a revenue of $2.48 billion, the company beat the analyst estimate of $2.09 billion and also improved upon its own results over the same period in 2020. Mind you, much of this success was attributed to production in Wyoming's Green River Basin's Wamsutter Field and Williams JV with Crowheart.

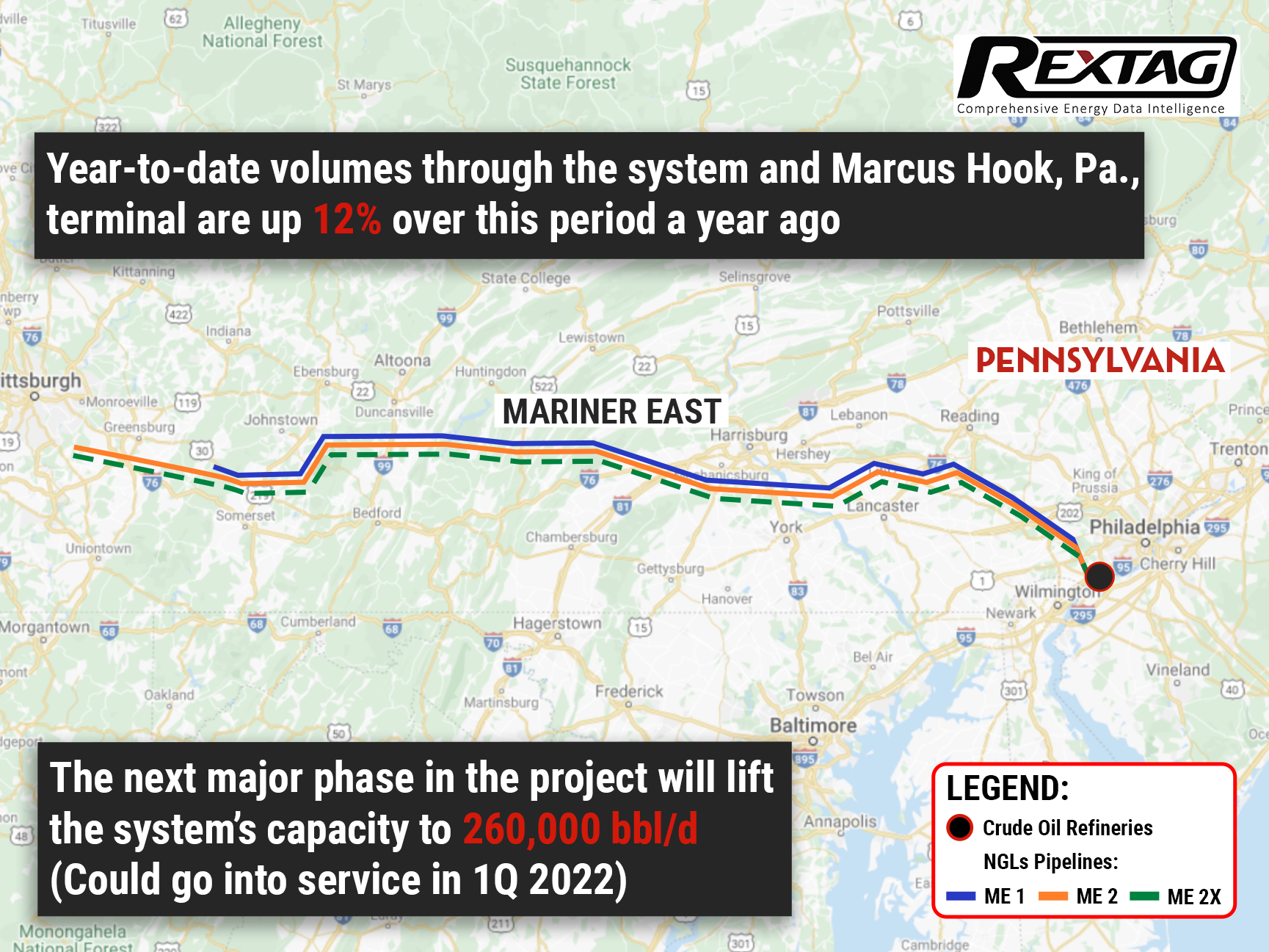

The Final Stretch: Energy Transfer Pushes For Mariner East Project Ahead Of The Stunning Q3 Results

Energy Transfer's lead in the world's NGL exports booked the company another successive quarter. With a global market share of almost 20%, the company is nigh unstoppable. But will it be enough to, finally, push the Mariner East project over the edge? If everything goes as planned, Mariner East's last segment could be operational by the end of the first half of 2022.

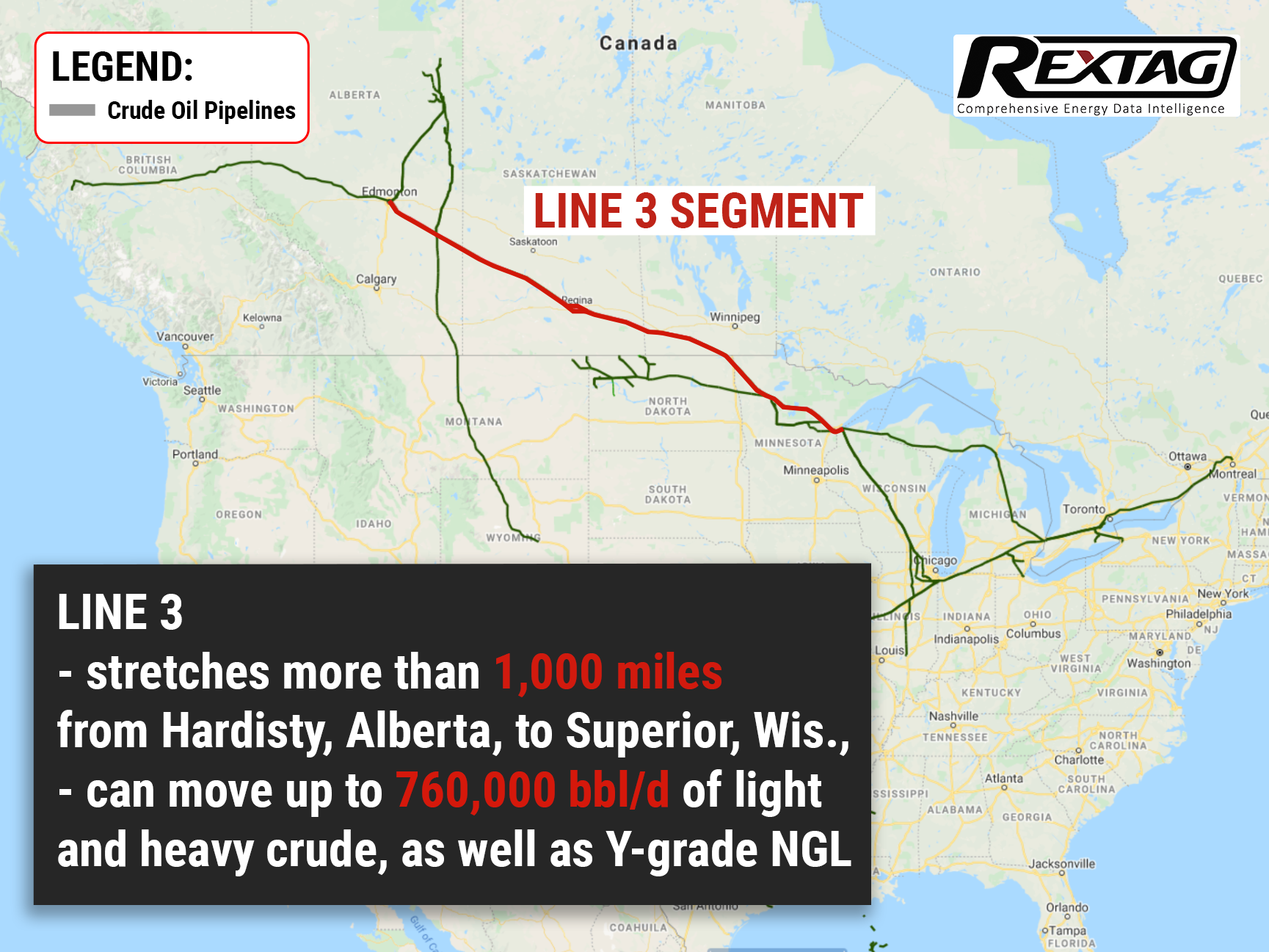

Delays Are Finally Over: Enbridge Reports Strong Third Quarter 2021

Enbridge Inc. finally delivered on several of its long-overdue promises, including the $4 billion Line3 Replacement project. Which consisted of replacing an existing 34-inch pipe with a new 36-inch one for 13 miles in North Dakota, 337 miles in Minnesota, and 14 miles in Wisconsin. Midstream companies, in general, had a stunning Q3. It was the first quarter in two years that no midstream index members cut their dividends.

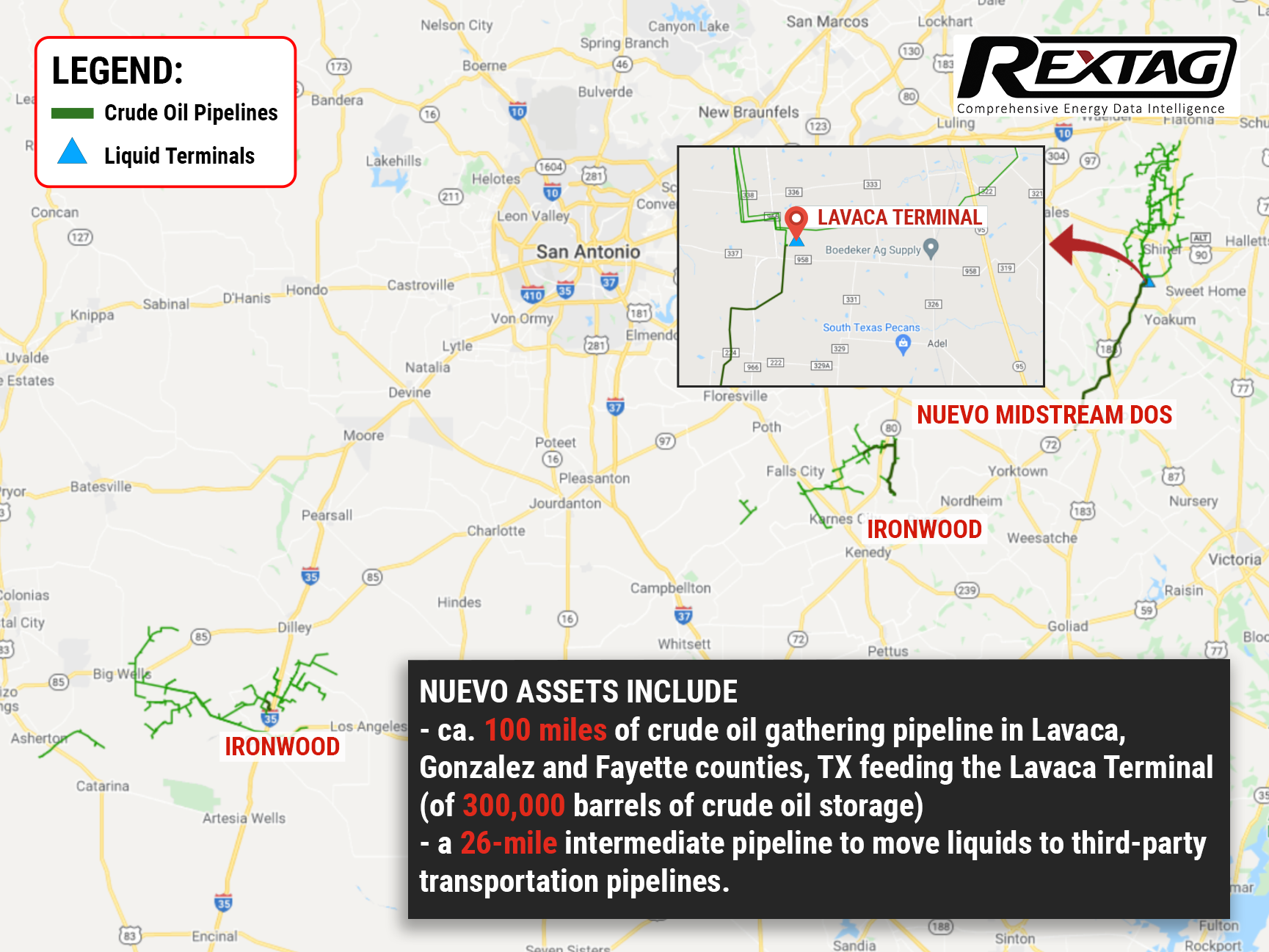

Expansion Is The Goal: Ironwood II Completes Asset Merger And Assumes Management of Nuevo Midstream Dos’ Eagle Ford Assets

Ironwood Midstream expanded its operations in the Eagle Ford region through its merger with Nuevo Midstream. Thanks to this, Ironwood II has increased its crude oil and natural gas throughput capacities in the famous shale to approximately 400,000 bbl/d and 410 MMcf/d, respectively. With 390 miles of pipelines, the company manages 245,000 acres of dedicated land.

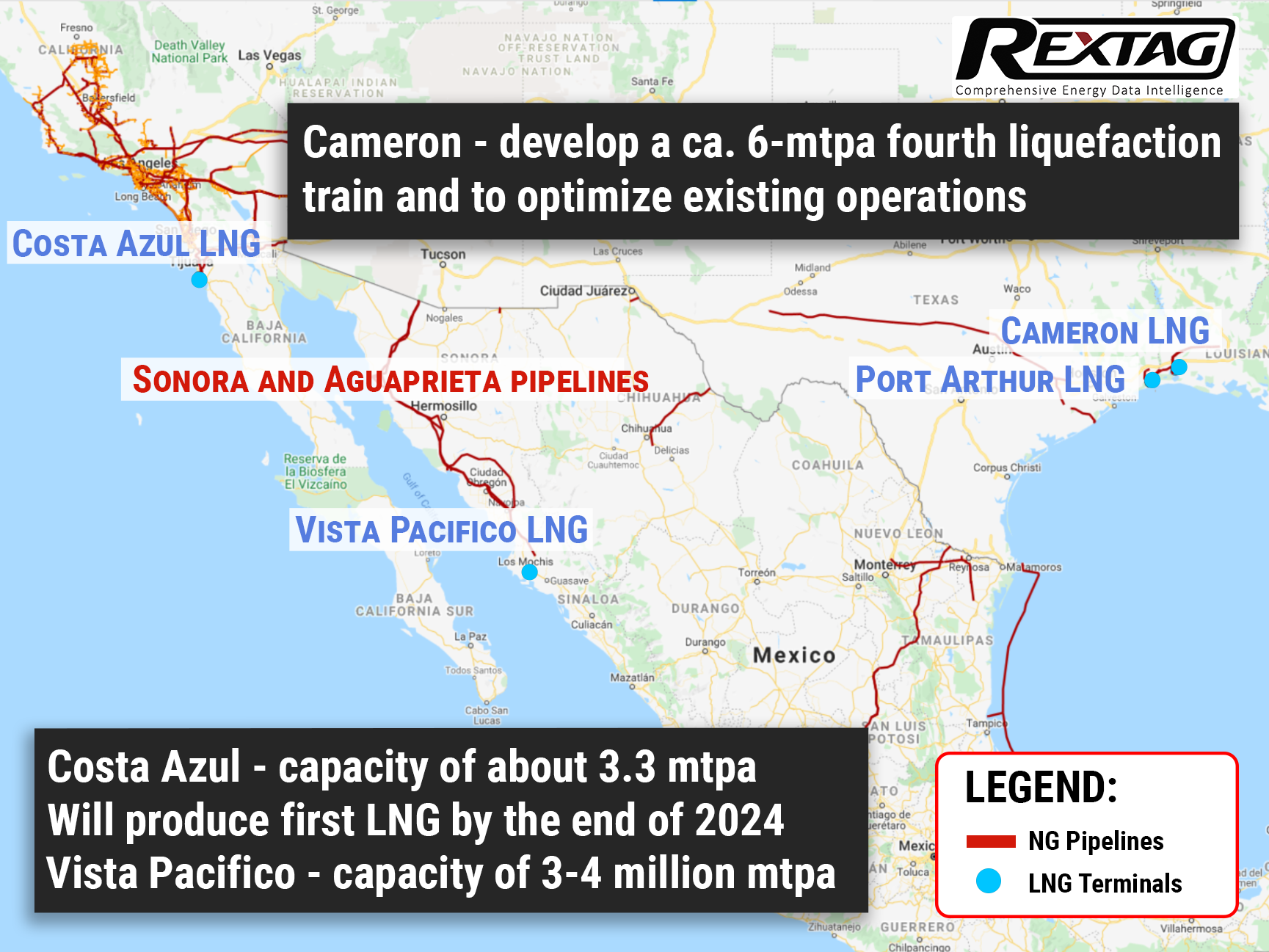

Pivot to the South: LNG Plants Under Development by Sempra Energy in Louisiana and Mexico

Sempra Energy would develop the 4.0-mmtpa Vista Pacifico LNG export facility located next to the company's Terminal for Refined Products in Topolobampo in a bid to provide gas from the Permian basin in Texas and New Mexico to Asian markets. Once marketing begins, Sempra's management expects Vista Pacifico to be oversubscribed.

Ain't Nothing Like a $2 Billion Deal: Oasis Sells Midstream Affiliate to Crestwood

Crestwood & Oasis Midstream merge to create a top Williston #basin player. $1.8 billion deal is expected to close during the Q1 of 2022. The transaction will result in a 21.7% ownership stake for Oasis in Crestwood common units. The remaining ownership of Oasis in Crestwood will also be of benefit to the company since it will create a diversified midstream operator with a strong balance sheet and a bullish outlook after this accretive merger.

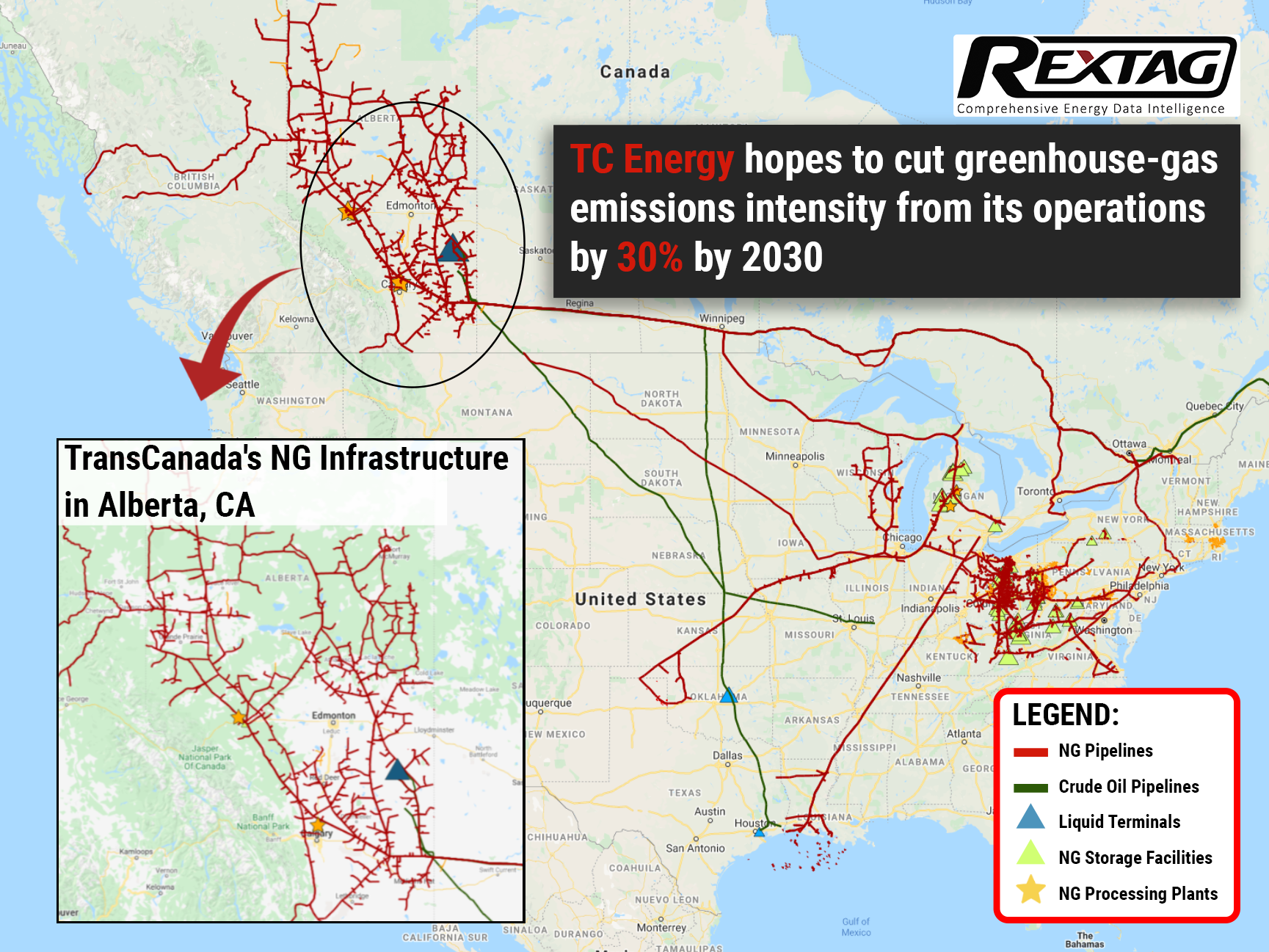

The green trend: TC Energy pledges to be carbon-free by 2050

TC Energy, the Canadian gas giant, recently announced its environmental, social, and governance goals, as well as emission reduction strategies. The company aims to become 100% emission-free by 2050 while promising to cut greenhouse gas emissions intensity from its operations by 30% by 2030 as an interim measure.